The Latest

-

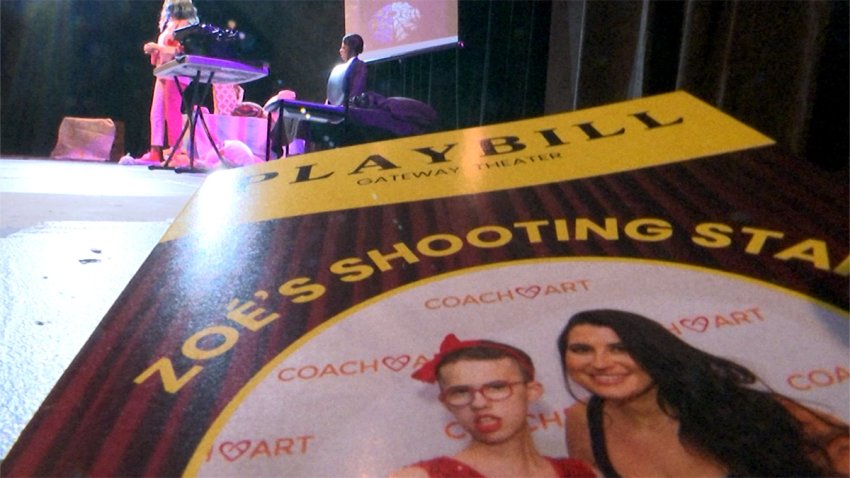

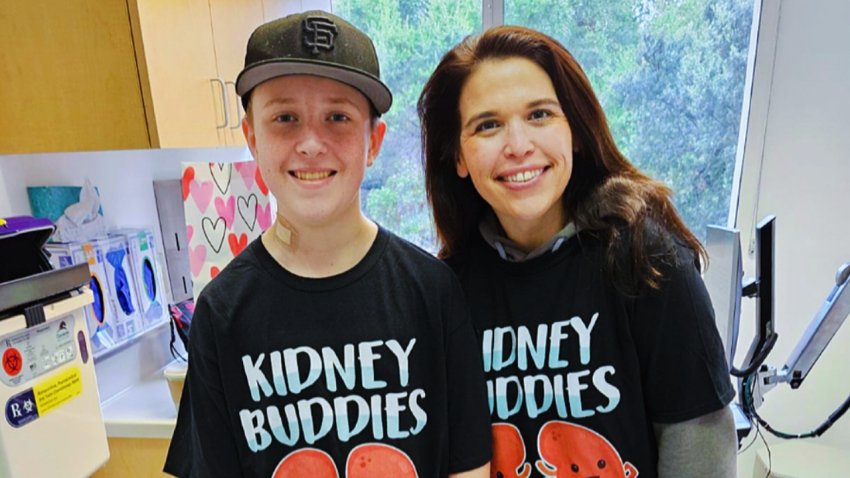

One Organ Donor Can Save 8 Lives, And Other Facts About Organ Donation

103,981 people are currently on the national transplant waiting list, including more than 2,100 children.

Promoted By Stanford Medicine Children's Health -

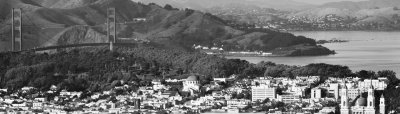

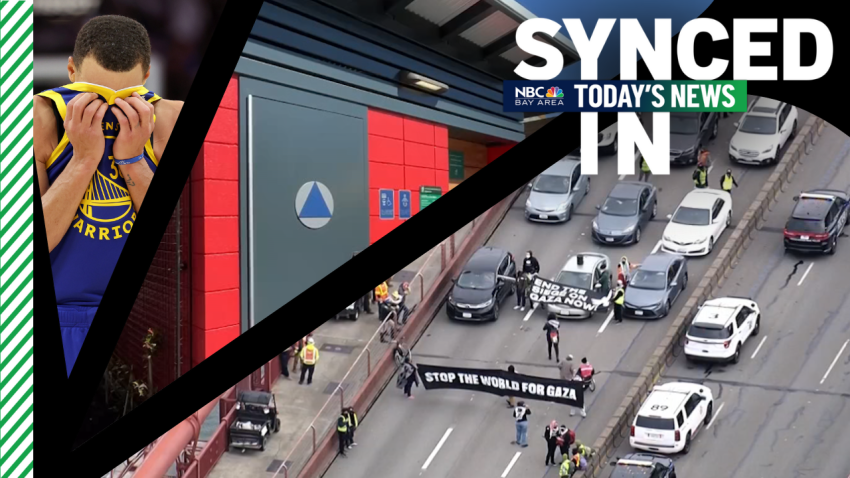

Golden Gate Bridge protest: San Francisco DA Brooke Jenkins asks for public's help to determine charges

San Francisco District Attorney Brooke Jenkins is asking for the public’s help to determine what charges should be filed against the 26 people who were arrested Monday during protests on the Golden Gate Bridge.

-

Planting Justice nursery launches new farming initiative

Earth Day is next week, and a new initiative to plant trees, fruits and vegetables is underway in the East Bay, where a long-standing nursery run by residents and formerly incarcerated people is taking the lead. Vianey Arana reports.

-

Chef's journey from the Bay Area to Paris

From acclaimed pastry chef at one of the Bay Area’s most famous restaurants, to international food author and blogger. David Lebovitz has had a storied culinary career. Now a Paris transplant, who better to train NBC Bay Area’s Jessica Aguirre for the Paris 2024 Olympic Games.

-

-

San Francisco's parking ticket crack down

San Francisco parking control officers may soon be cracking down on drivers who are a little too lax in how they park.