The Latest

-

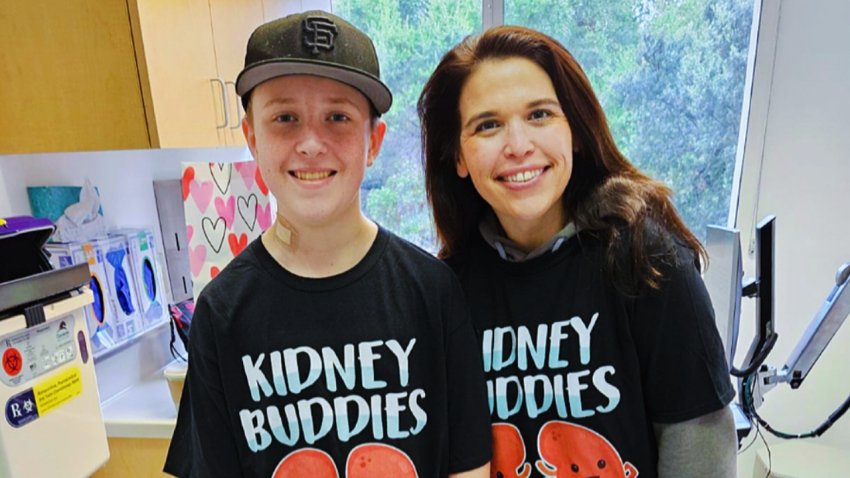

One Organ Donor Can Save 8 Lives, And Other Facts About Organ Donation

103,981 people are currently on the national transplant waiting list, including more than 2,100 children.

Promoted By Stanford Medicine Children's Health -

Tesla laying off more than 10% of workforce. Here's why

The Bay Area automaker said that within the last couple of months, it’s seen fewer than expected deliveries, a falling stock price, and mounting complaints about its new cybertruck.

-

Recount in race for California's 16th Congressional district set to begin

The process of recounting votes in the tied race between two political heavyweights looking to replace the retiring Anna Eshoo in Congress is about to begin.

-

Portion of Crow Canyon Road to be closed for repairs through August

A portion of Crow Canyon Road will be closed through August for road work, according to the Alameda County Sheriff’s Office.

-

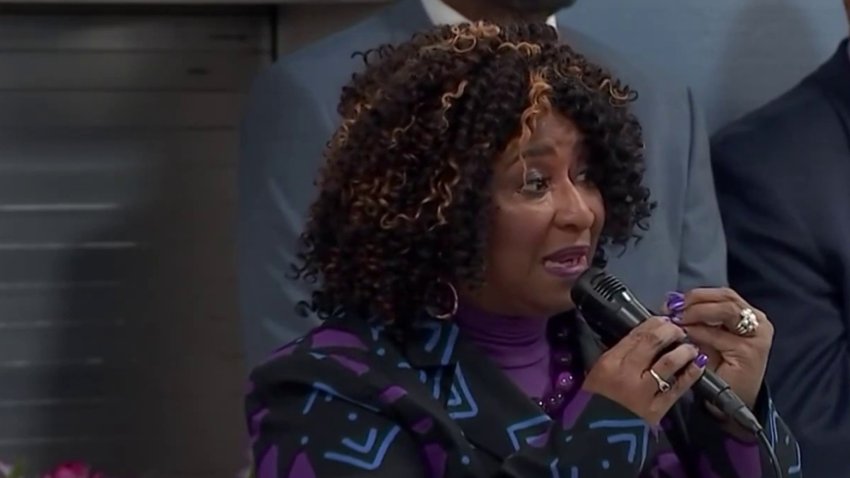

Bay Area faith leaders express concerns over tensions in the Middle East

Bay Area faith leaders are hoping the increasing tensions in the Middle East won’t widen the conflict further or lead to an increase in hate crimes and violence in the region.

-

1 dead in crash in Antioch

A 30-year-old man was killed Sunday in Antioch after the car he was driving T-boned another vehicle, according to police.

-

2 San Francisco jails on lockdown as deputies, union call for National Guard

The union representing San Francisco’s deputy sheriffs demanded assistance Saturday from the California National Guard to solve a critical staffing shortage in the county’s jails.