Political analysis: Donald Trump's hush money trial

NBC Bay Area’s Janelle Wang spoke to Political Analyst Larry Gerston about the legal battles former President Donald Trump is facing in New York.

-

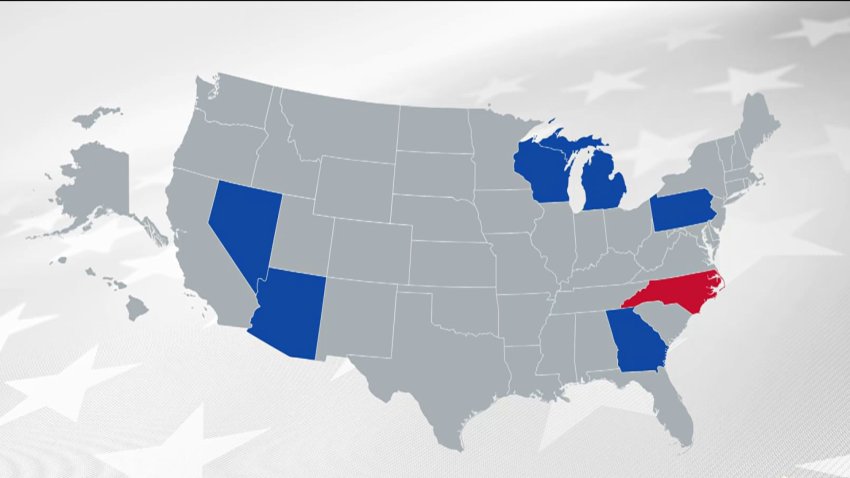

How to break a tie

NBC Bay Area political analyst Larry Gerston provides the likely sources the 16th Congressional District candidates will rely on for November victory.

-

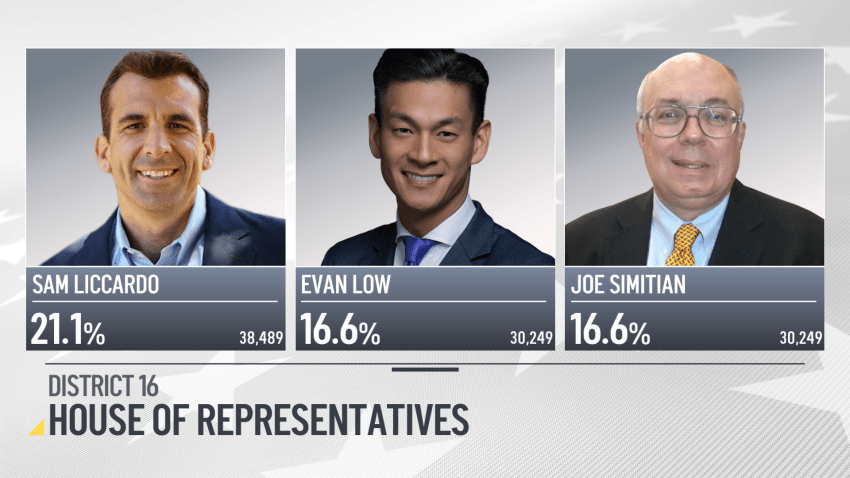

What's next? Evan Low, Joe Simitian tie for second place in race for California's 16th Congressional District

After weeks of anticipation and counting votes, California’s 16th Congressional District race to replace Anna Eshoo took an unexpected turn on Wednesday as both second-place candidates tied in t... -

Analysis: What are RFK Jr.'s chances in the election?

NBC Bay Area political analyst Larry Gerston examines Robert F. Kennedy Jr.’s chances in this year’s election.

-

Mifepristone mystery

NBC Bay Area political analyst Larry Gerston offers an assessment of the Supreme Court’s direction on the Mifepristone case and its implications.