It's become a trending topic on Twitter: "Payment status not available."

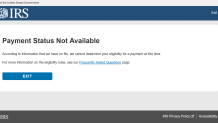

Those four words are frustrating taxpayers seeking information about their federal stimulus payments from the U.S. Internal Revenue Service -- only to receive this error message:

Dozens of NBC Bay Area viewers reached out this week to share their issues receiving an anticipated stimulus payment, describing a variety of problems. All said they were unable to reach anyone with the IRS for help.

Ideally, you should be able to find your payment at IRS.gov, by clicking the "Get My Payment" button. But that's where many users are getting hung up, and seeing the "payment status not available" message.

The IRS says it could mean a lot of things:

- You are not eligible to receive a stimulus payment.

- The IRS does not have a tax return from you in its records for 2018 or 2019.

- The IRS doesn't have all your information available yet.

So, what should you do to get paid?

Local

The IRS encourages you to check again -- but only once per day. It's only updating payment information once daily. If you check too frequently, the IRS warns you could be locked out for 24 hours.

Some viewers tell us their deposits were sent to the wrong bank accounts. For now, they'll have to wait, and watch the mail. The IRS says it will wait for the old bank to reject the deposit. Then, it will mail a paper check. You may want to check with the bank yourself, to see if you can still access the funds.

When you do get paid via direct deposit, you should see "TAX REF" or "TAX REFUND" in the deposit line. Keep in mind, it may not be the $1,200 you've heard about; that amount is the maximum per person. If you receive less, it's because your income is more than $75,000. If you earn more than $99,000, you won't get a payment at all.

A reminder: the IRS will send a letter to every taxpayer who receives a stimulus payment, within 15 days of the payment going out. If you receive the letter, but you didn't get paid, the letter will provide instructions to report the missing money.