Over half, 54%, of Americans say they're not financially prepared to handle a contagious disease like coronavirus that may limit their ability to work for a few weeks, according to a recent survey conducted on behalf of Prudential of just over 2,000 U.S. adults.

There are now over 137,000 confirmed cases of coronavirus COVID-19 worldwide and at least 1,700 people who have been confirmed to have the virus in the U.S., according to data compiled by Johns Hopkins University.

For Americans, there are two major types of financial shocks to worry about if you fall ill with coronavirus: income loss and medical costs, Rob Levy, vice president of the Financial Health Network, tells CNBC Make It.

About 45% of those surveyed by Prudential are worried about how quarantines will affect their ability to work for several weeks. People who have a stable job with a good employer that includes high-quality health insurance coverage and ample paid sick leave policies are "better positioned" to deal with unexpected expenses, such as being out of work from coronavirus, Levy says.

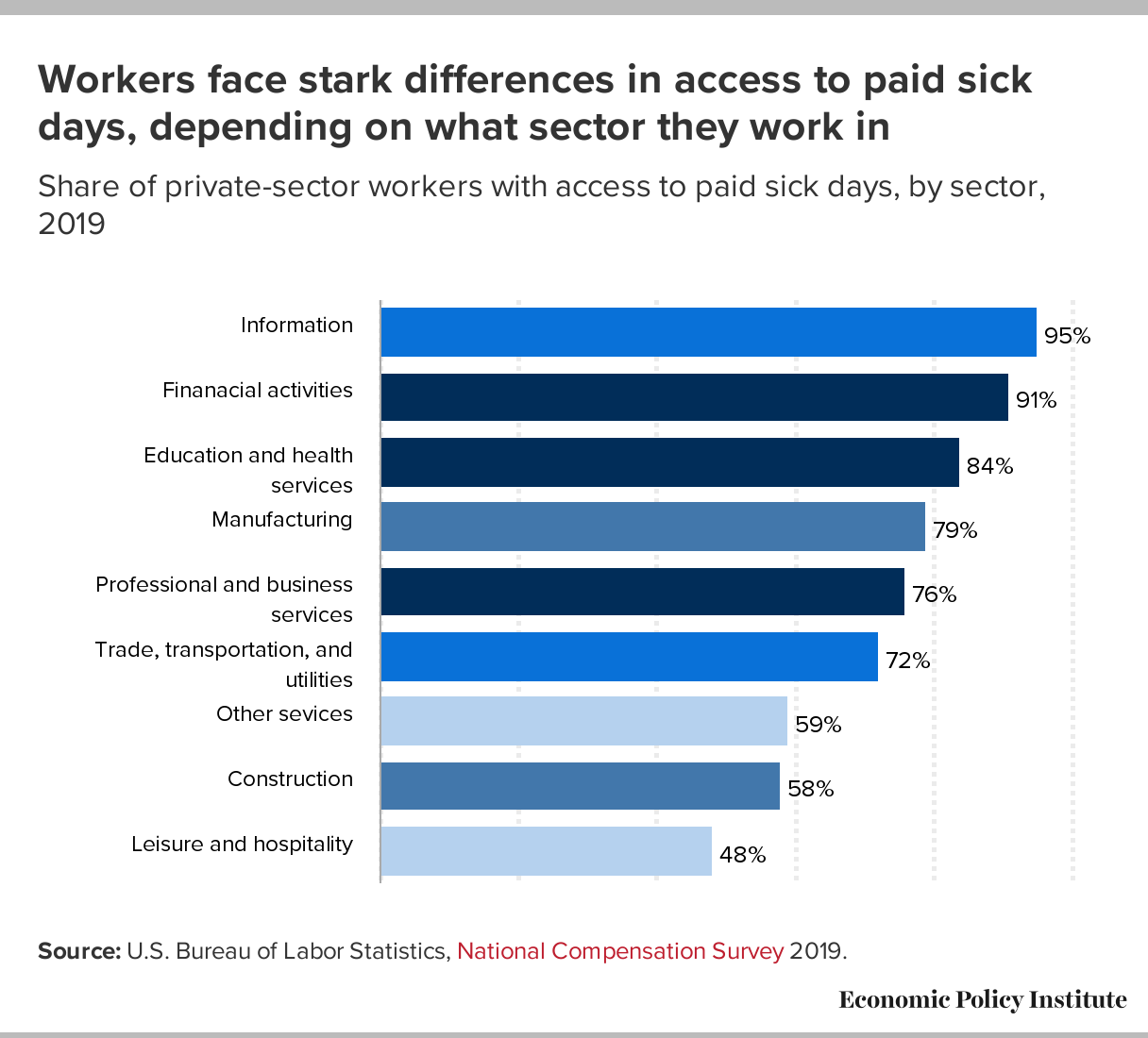

But most Americans don't have the ability to work from home or take two weeks of paid sick days. Only about 29% of all workers can work from home, according to the Bureau of Labor Statistics. And while 73% of workers nationwide have access to paid sick days, most do not have enough time banked to be able to take off work for a 14-day quarantine, according to the Economic Policy Institute. Meanwhile, only about one in three minimum wage employees have the ability to earn paid time off.

"Income loss can be a severe financial strain for those people who don't have paid sick leave from their employer or who work for themselves and simply don't get paid if they don't work due to illness," Levy says.

Money Report

Understanding how medical costs may play out

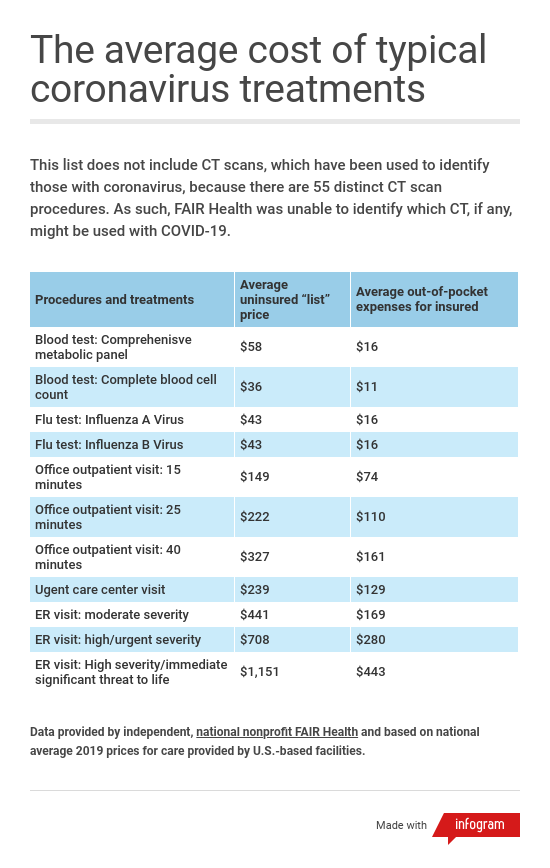

If you do contract coronavirus, you'll likely need to be tested. But who pays for the cost of these tests, which Rep. Katie Porter (D-Calif.) estimates is about $1,300, is up for debate.

Last week, New York's Governor Andrew Cuomo said New York health insurers will be required to waive cost-sharing with testing for novel coronavirus including emergency room, urgent care and office visits. California and Washington, two other states that have big pools of confirmed cases, also require insurers to make testing free.

https://twitter.com/RepKatiePorter/status/1238147835859779584

Across the country, any tests performed by the Centers for Disease Control and Prevention are free. Medicaid and Medicare will cover testing costs, Vice President Mike Pence announced last week. Major insurance providers Anthem and Cigna announced they would waive out-of-pocket fees for lab tests for coronavirus, while dozens of others have agreed to some coverage. Industry trade group America's Health Insurance Plans published a list of specifics.

But most of these policies only promise to cover the costs of testing. If you should need treatment for coronavirus, most Americans will be on the hook for at least some of the expense, the biggest of which will be meeting your deductible, especially if you're in a high deductible plan. The second highest will be the risk of out-of-network or surprise bills if you are hospitalized and/or require ambulance transportation.

Medical treatment costs will likely include fees for doctors, hospital stays, testing and the cost of medication — all of which can vary dramatically depending on whether you have health insurance and, if so, how that plan is structured. This can range from hundreds to thousands of dollars, depending on your insurance coverage, Levy says.

"At this point, a great deal is in flux with respect to who will be charged what with respect to testing and treatment of coronavirus," says Kim Buckey of DirectPath, an organization that guides employees to make better health care decisions.

How you may be able to reduce health care costs

For most people, symptoms of the illness are mild to moderate — similar to that of a severe cold or the flu — so they should be able to treat themselves at home, even if they test positive for the coronavirus, Buckey says. But if you do think you're experiencing more serious symptoms, make sure you seek out medical care. If that happens, there are a few ways experts say you may be able to cut down your chances of getting hit with a massive medical bill.

Call first

If you believe you are showing symptoms, call your doctor for advice. If you don't have a primary care physician, call your local urgent care clinic or hospital and let them know you believe you're experiencing symptoms. "They will ask you some questions and give you some advice," Buckey says.

If you're not sure how to proceed, call your state health department — many have specific and dedicated call centers to handle any COVID-19 questions and concerns. Some major cities such as Los Angeles and New York City also have dedicated resources and hotlines.

Check out telehealth options

This is a good time to make use of any telehealth or 24-hour nurse hotline programs offered by your employer or health insurance company, Buckey says. "These may save you a trip to the doctor's office entirely, and at the very least will cost less than a trip to the ER," she says. Typically, the telehealth doctor or nurse will be able to assess whether you need to come in or if you can be treated at home.

Plus if you use a telehealth option, you minimize the risk of infecting others in the waiting room. And if you're healthy, you minimize your risk of getting infected yourself. Wait times to get in touch with a doctor via this route are also likely to be shorter.

Avoid the ER as your first stop

Unless you are experiencing severe symptoms, head to a doctor's office, urgent care clinic or retail clinic to get checked out first. "This will keep your costs lower and free up needed emergency resources for the seriously ill," Buckey says.

Keep in mind that tests are still limited at this point and will be reserved for those who are severely ill and those who recently traveled to affected countries or have interacted with those who have. If you head to the hospital hoping to be tested right away, you may be out of luck.

Track costs

At the end of the day, don't put your health at risk, says Jonathan Wiik, principal of health-care strategy at TransUnion Healthcare and author of "Healthcare Revolution: The Patient Is the New Payer." Cost barriers should "absolutely not" keep people from being tested and treated for coronavirus.

If your case does turn severe and you're hospitalized, Buckey recommends having a friend or family member keep track of what tests you are given, what medication and treatment you receive and which doctors you see (and how often). "That information may be helpful when you receive your bill," she says. Especially some of these costs may be covered or waived.

But again, experts stress that for most Americans, it's about getting the basics right — taking care of yourself by getting enough sleep, exercising and eating healthy. Make sure to wash your hands regularly throughout the day, disinfect hard surfaces and avoid touching your face.

"While consumers can take some steps to prepare themselves for a shock like the coronavirus, much of the responsibility lies in the hands of our government institutions, employers and the financial system to address a nationwide crisis," Levy says.

Don't miss: 32% of American workers have medical debt—and over half have defaulted on it

Check out: The best credit cards of 2021 could earn you over $1,000 in 5 years