When Lilly Faust graduated from college in December, she was fortunate to land a job right away.

She also managed to move out on her own, with a roommate, into an apartment in Montclair, New Jersey.

"I feel very proud of myself," said Faust, 22, who is now a first-grade teacher in New Jersey.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

"I was that broke college kid who was just trying to make ends meet," she added. "It feels really good to have my own money coming in and being able to support myself."

More from Invest in You:

College Money 101: From student loans to setting up a budget

What Gen Z and millennials want from their employers

It's a good time for young people to invest in the markets

She made it happen with careful planning.

Money Report

Faust worked part-time jobs while attending New Jersey-based Stockton College and started her own business, selling clothing online. That enabled her to save for a down payment on an apartment. She's now saving $1,000 per paycheck to go toward student loans and another $1,000 each pay period to live on this summer, when she doesn't receive a salary.

Transitioning from school to the adult world of work and money isn't necessarily easy. Yet getting off on the right financial footing can set you up for success later on.

Saving money

Many young adults think about getting rich quickly when investing, said certified financial planner Cathy Curtis, founder and CEO of Curtis Financial Planning in Oakland, California.

"A lot of young people have a distorted view on how to invest in the markets," she said. "They invest in IPOs, companies they think are cool."

In reality, you should be investing in index funds and watching your money grow slowly, she said.

Therefore, you should open a 401(k) if your employer offers one and contribute at least up to what the company matches, she said. If that isn't available, you should open a Roth individual retirement account.

If you wait too long to start, you will miss out on the compounding interest that can really make your money grow, said CFP Tom Henske, managing partner at New-York based The Affluent Insurance Advisor.

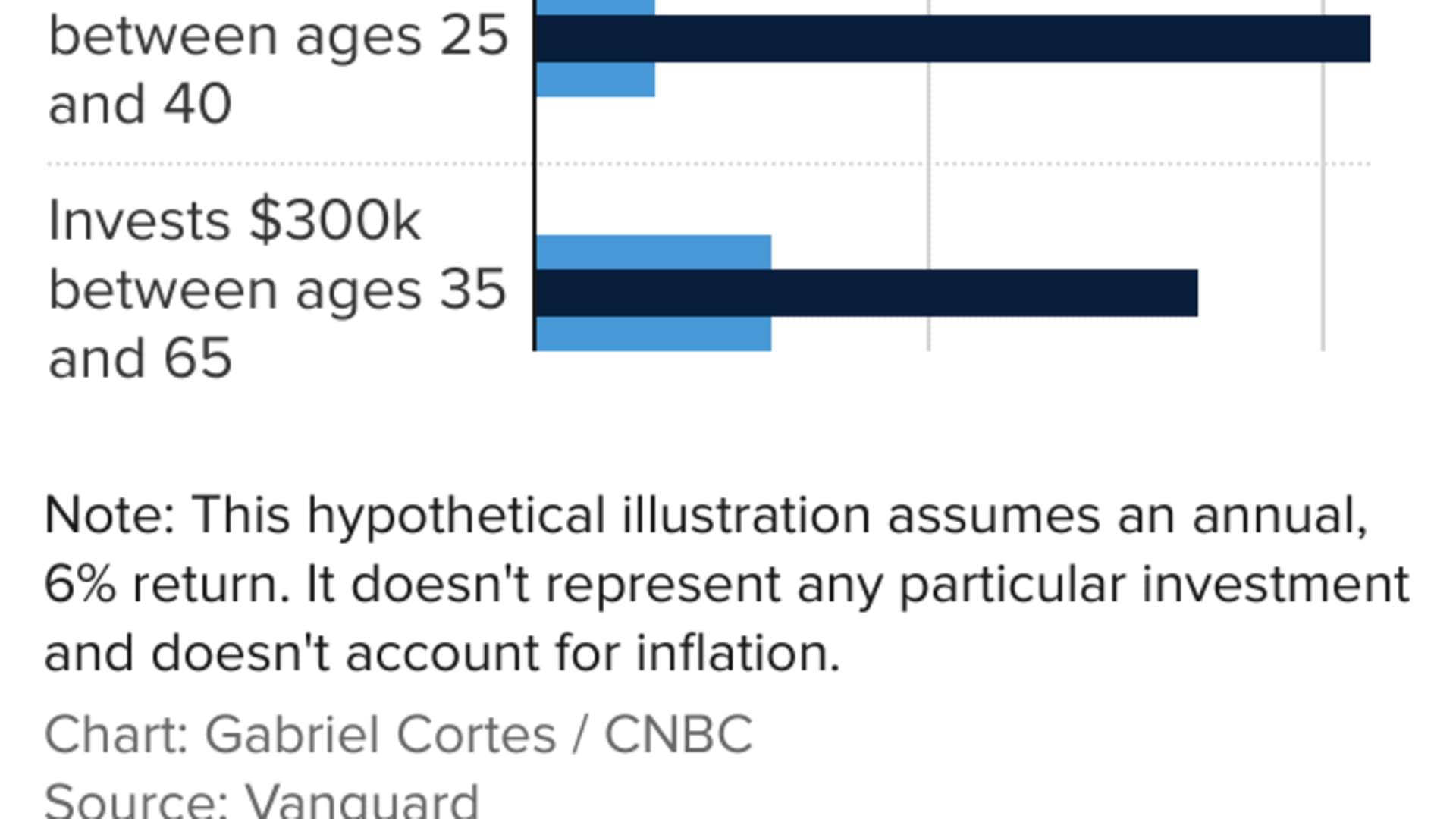

According to an analysis by asset manager Vanguard, someone who starts saving $10,000 a year at age 25 in a 401(k) with a matching contribution and stops by age 40 will have more than $1 million in retirement.

Someone who starts at age 35 and saves $10,000 a year for the next 30 years will have $838,019 in retirement, according to Vanguard, which used a hypothetical 6% annual return and didn't account for inflation.

It's also important to put money away for an emergency, separate from your retirement savings.

Making a budget

A budget essentially keeps track of what money is coming in, such as your paycheck, and what is going out to pay bills.

When setting your budget, treat your savings as a bill, Henske advised.

"If you start with things like nights out and eating out and social things you will save just what is left over," he said. "Don't do that."

"Start with what you save and put everything else around it."

Building credit

If you don't have a checking account, open one, Curtis said. The same goes for a credit card, as long as you use it responsibly and don't accumulate debt.

"Building credit is the foundation of your financial life as you get into adulthood," she said. "The sooner you get that started, the better."

Your credit impacts everything from your ability to get a loan or rent an apartment to the amount of interest you'll pay on any loans.

If a credit card isn't a good option right now, consider building credit with a secured card, which is backed by money you deposit into an account.

Finding a job

Although the inflation rate is high and there are some concerns about a looming recession, college graduates are generally finding a positive labor market right now, reports show.

The number of entry-level job postings on LinkedIn grew by nearly 17% in the first three months of 2022 compared with the same period last year, according to the social media giant. Employers plan to hire 26.6% more new graduates from the Class of 2022 than they did from the Class of 2021, according to the National Association of Colleges and Employers.

All of this, coupled with the tight labor market and the so-called Great Resignation, is giving graduates confidence. Four out of 5 college graduates believe they'll get a job offer that matches their career goals, according to job site Monster.

"Job-seekers are in the driver's seat," said Monster career coach Vicki Salemi. "They do have the greater advantage [over employers] in the entry-level job market."

Her advice: Look for the right fit, which means factoring in benefits in addition to salary, ask questions during the interview process, network with family, friends and professors, and negotiate any offer you receive.

Understanding your benefits

Once you land a job, make sure you understand your workplace benefits, especially the financial ones, such as retirement plans, insurance and health savings.

Be sure to get long-term disability insurance, which will cover you if you have to miss work due to an illness, Henske said.

When it comes to health insurance, he said, young adults should opt for a high-deductible plan since they don't use insurance as much in their 20s compared with later in life.

This way, you can open a health savings account, which allows you to contribute money tax-free. That money also grows tax-free throughout your lifetime, and withdrawals aren't taxed as long as they are used for qualified health expenses.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version, Dinero 101, click here.

CHECK OUT: Meet a 34-year-old who has sold over 11,000 items on Etsy and makes nearly $3,500/month in passive income with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.