- President Biden said Wednesday that the White House would forgive up to $10,000 in federal student debt per person for most borrowers and up to $20,000 for Pell Grant recipients.

- Some consumer groups and lawmakers hailed the move while also saying more aid is necessary.

President Joe Biden's long-awaited plan to forgive student debt, announced Wednesday, drew immediate pushback from some lawmakers and consumer groups even as they praised the historic measure.

The White House said it would cancel $10,000 in federal student debt for most borrowers and up to $20,000 for recipients of Pell Grants, which are available to undergraduates based on financial need. The plan may eliminate balances for at least 9 million borrowers, according to higher education expert Mark Kantrowitz.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

Relief is limited based on income qualifications — only individuals with annual income less than $125,000 and couples or heads of household earning less than $250,000 qualify. It also extends a "final" pause on loan payments through Dec. 31; that pause, in place since March 2020, has been extended seven times.

In a tweet, Biden touted the move as a fulfillment of a campaign promise that gives "working and middle class families breathing room as they prepare to resume federal student loan payments in January 2023."

Money Report

More from Personal Finance:

Biden cancels $10,000 in federal student loan debt for most borrowers

What to know about Biden's forgiveness plan: How it works, when to apply

Timeline: Key events on the path to student loan forgiveness

Biden's student loan forgiveness will cost taxpayers, prompt inflation: Experts

Student loan payment pause extended through December. What to know

Here's what President Biden's student loan forgiveness means for your taxes

Biden 'should have, and could have, done much more'

Astra Taylor, co-founder of the Debt Collective, a union for debtors, called Wednesday's announcement "bittersweet."

"On the one hand, this is a landmark victory for our movement," she said in a statement. "Yet, President Biden should have, and could have, done much more than cancel $10,000 or [$]20,000 — and he could have made the relief automatic, instead of imposing unnecessary hurdles."

Nearly 8 million borrowers may be eligible for automatic relief; however, some borrowers may need to apply if the U.S. Department of Education doesn't have relevant income data, according to the federal student aid website. That application isn't yet available.

"We intend to keep fighting until all student debt is canceled and college is free," Taylor said. "If President Biden can cancel this much debt he can cancel it all."

Biden paired the debt cancellation and payment pause with a measure to cap undergraduate loan repayments at 5% of monthly income.

Warren, Schumer pledge to 'pursue every available path'

Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Elizabeth Warren, D-Mass., hailed the policy announcement Wednesday as "the single most effective action that the President can take on his own to help working families and the economy."

The duo had been pushing the White House to cancel up to $50,000 in federal student debt — and they alluded to an ongoing fight for more relief.

"Make no mistake, the work — our work — will continue as we pursue every available path to address the student debt crisis, help close the racial wealth gap for borrowers, and keep our economy growing," Schumer and Warren said.

Canceling $10,000 'hardly achieves anything'

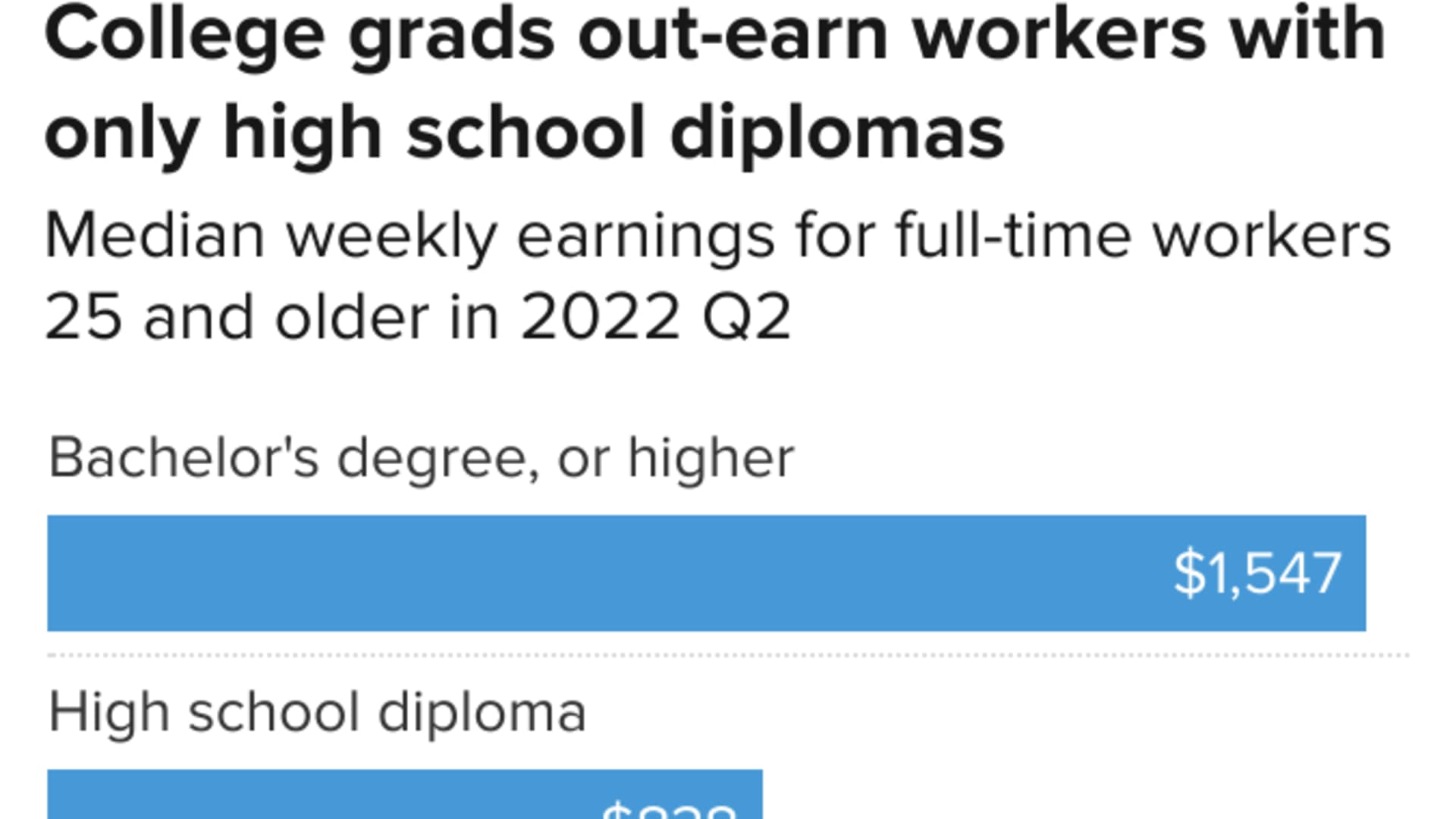

Derrick Johnson, president and CEO of the NAACP, lamented that Biden didn't cancel $50,000 of loans or more per borrower. He called student debt forgiveness a "racial and economic justice issue" that could help close the racial wealth gap, which often pushes Black students to borrow more than other students.

"Canceling just $10,000 of debt is like pouring a bucket of ice water on a forest fire," Johnson wrote in an op-ed. "It hardly achieves anything — only making a mere dent in the problem."

Data suggests that doubling the maximum forgiveness amount — to $20,000 — for Pell Grant recipients will most benefit Black student borrowers. To that point, 72% of Black students received a federal Pell Grant during the 2015-16 school year, about double the share of Asian and white students that year, according to the most recent data from the National Center for Education Statistics.

Carlos Moreno, a senior campaign strategist at the American Civil Liberties Union, applauded the policy's impact on Black borrowers.

"Student debt cancellation will help secure financial stability and mobility for people of color — particularly Black Americans — who are disproportionately burdened with student debt while providing immediate financial relief and peace of mind for millions of Americans," Moreno said.

Forgiveness could 'make inflation even worse'

While some voiced concern that the Biden administration didn't go far enough, others said the White House measures went too far and threaten to exacerbate stubbornly high inflation.

"Washington Democrats have found yet another way to make inflation even worse ... and achieve nothing for millions of working American families who can barely tread water," said Senate Minority Leader Mitch McConnell, R-Ky.

But Adam Green, co-founder of the Progressive Change Campaign Committee, framed the measure as "a bigger investment [in dollar terms] than the G.I. Bill — in young people and millions of others."

"Today, the cancellation of up to $20,000 of student debt for as many as 43 million Americans will have a historic impact on Americans who have faced a uniquely generational burden," Green said.