Bay Area voters may be asked to approve a one-cent sales tax in 2020 that would fund a wide array of transportation projects and improvements across the region.

The sales tax has been proposed by a coalition of policy advocacy groups, including the Bay Area Council, the San Francisco Bay Area Planning and Urban Research Association, and the Silicon Valley Leadership Group.

The coalition has dubbed themselves FASTER Bay Area and presented their plan to the BART Board of Directors at a meeting in Oakland on Thursday. According to their presentation, they project the tax could raise up to $100 billion over 40 years.

The funds would be dispersed to regional transit districts, including BART, the Metropolitan Transportation Commission and others. The policy groups are primarily interested in "big, transformational projects that better connect jobs to housing through a more integrated transit system," according to a memo by BART general manager Robert Powers.

That could include regional rail improvements, including more exclusive right of way for BART and Caltrain, and more express freeway lanes.

It would also emphasize closing gaps between transit systems, more fare integration and improvements to transit hubs and stations.

For BART, it could include funding for a new transbay rail crossing to complement the existing Transbay Tube, which is often overcrowded during peak hours. It could also include more mundane upgrades to BART's existing infrastructure and earthquake safety improvements in the Caldecott Tunnel.

Local

The FASTER advocates cited a 21 percent increase in commute times in Silicon Valley from 2010 to 2017 and said that was contributing to nearly half of residents responding to a recent Bay Area Council poll saying they were considering leaving the Bay Area.

FASTER has conducted polls that indicate voters are open to raising taxes for regional transportation improvements and that differences in support between funding measures are slight.

But some BART directors had concerns about the use of a sales tax, which tends to impact low-income residents more and can fluctuate widely in the event of an economic downturn.

"I am really concerned about the one-cent sales tax," said Director Janice Li, who represents portions of San Francisco, adding that she was disappointed the advocates didn't present any alternatives.

"I think it would have been more appropriate if you said, 'here is a list of things that can get us to 100 billion, we think a sales tax is the best way,' but you didn't come with that list," Li said.

Director Rebecca Saltzman, who represents portions of Alameda and Contra Costa counties, agreed, and pointed out that the sales tax may require passage of statewide legislation first. California caps sales tax at 10.25 percent and Saltzman said some cities have already reached that maximum.

Furthermore, Saltzman argued that a mix of revenue streams would be better than a sales tax, which can be volatile in the event of a recession. Big projects could be forced to be put on hold when revenue plummets.

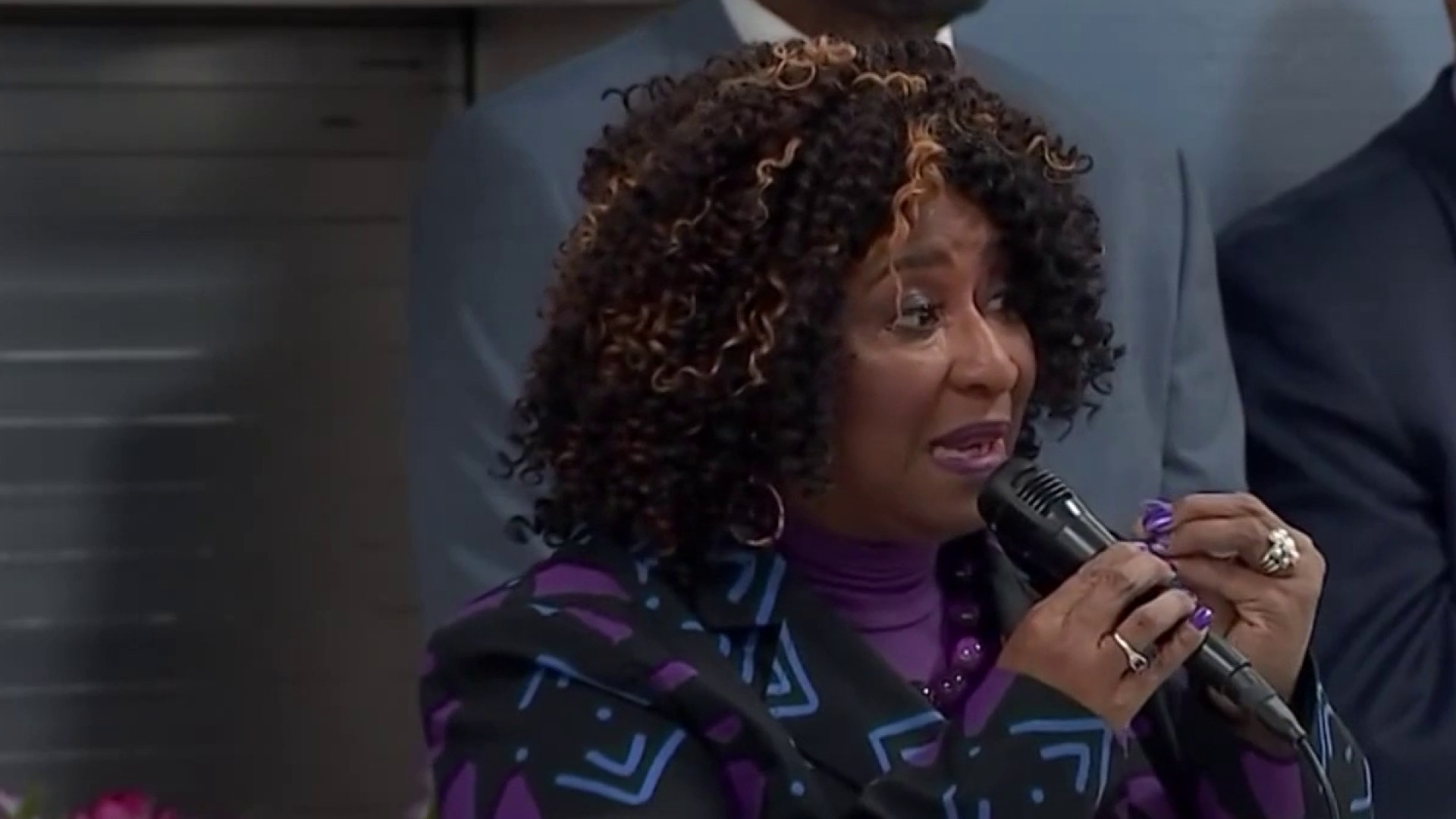

"Whatever mix you do, it's going to be more resilient than just having one type of tax," Saltzman said.

The sales tax could be on the ballot for all nine Bay Area counties in November 2020.