The mortgage company “Mr. Cooper” says one of its vendors inadvertently withdrew large sums of money from as many as 480,000 homeowners’ bank accounts without permission – causing some to overdraft.

Several people wrote to NBC Responds for help.

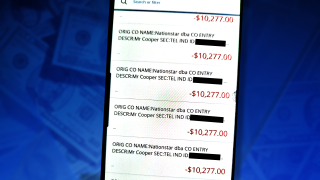

“[I] woke up to negative $60,000 in the bank,” wrote Deanna Shouldice from outside Chicago. “Our mortgage company deducted that much out of our account this morning.” Shouldice shared a screenshot of her bank account activity. It showed at least six back-to-back withdrawals for $10,277 each.

Shouldice is not alone. Edwin Dejesus of New York wrote to NBC responds with a nearly identical story.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

“They took $7,742 from my checking account leaving me with no funds,” he said. “I’ve never been late or delinquent with my payments,” Dejesus explained.

The Consumer Financial Protection Bureau said on Tuesday afternoon that it was aware of the unauthorized withdrawals. “The CFPB is taking immediate action to understand and resolve the situation that has affected hundreds of thousands of consumers,” said CFPB Acting Director Dave Uejio in a statement. NBC Bay Area asked what the “immediate action” entailed, but did not receive an immediate response.

In a statement issued Tuesday evening, Mr. Cooper said is acted quickly. "We immediately reported this error to our customers’ banks and worked with them to prevent any financial impact to our customer accounts." The company said it also added extra staff to its call centers to answer customer questions. It urged customers to call: 1-888-480-2432.

Local

On a special webpage for customers whose accounts were impacted, the company said, “all inaccurate charges are being corrected, and any impacted customers will not be responsible for any fees or other negative financial impact this may have caused.” The company also placed an alert on its blog noting that some customers are experiencing payment processing issue.

Mr. Cooper said it has taken action and “all duplicate transaction requests have been stopped.”

So, what happened?

Mr. Cooper said a payments vendor inadvertently "issued incorrect mortgage payment drafts" while testing its system. "That triggered multiple requests for funds from a number of Mr. Cooper customers’ accounts," the statement said.

The Mr. Cooper webpage stated that its computers had not been hacked. “This was a payment processing transaction error and neither your bank account, nor Mr. Cooper’s systems or accounts were compromised,” the webpage explained to customers.

What should customers do?

Mr. Cooper said impacted customers do not need to do anything right now. The company said it expected to correct the unauthorized withdrawals by the end of the day Tuesday. If you wish to call, the number is 1-888-480-2432.

What should you do if you see an overdraft or insufficient funds fee?

Mr. Cooper said you won’t have to pay. “In the event a customer is assessed a fee related to these transactions, they will be reimbursed,” the company said. That’s good news for consumers, because the average bank overdraft fee was more than $33 in 2020 -- an all-time high, according to Bankrate. Mr. Cooper said it was "not aware" of any customers whose incorrect drafts were not reversed.

The CFPB suggested that customers like Shouldice and Dejesus monitor their accounts and contact Mr. Cooper directly. The agency said customers may also submit complaints to the CFPB at www.consumerfinance.gov or toll-free at 855-411-2372.

Long term, customers should check their credit report — to make sure no overdraft fees were added to their file. An overdraft fee can negatively impact your credit history or score. You can review your credit report for free at www.annualcreditreport.com.