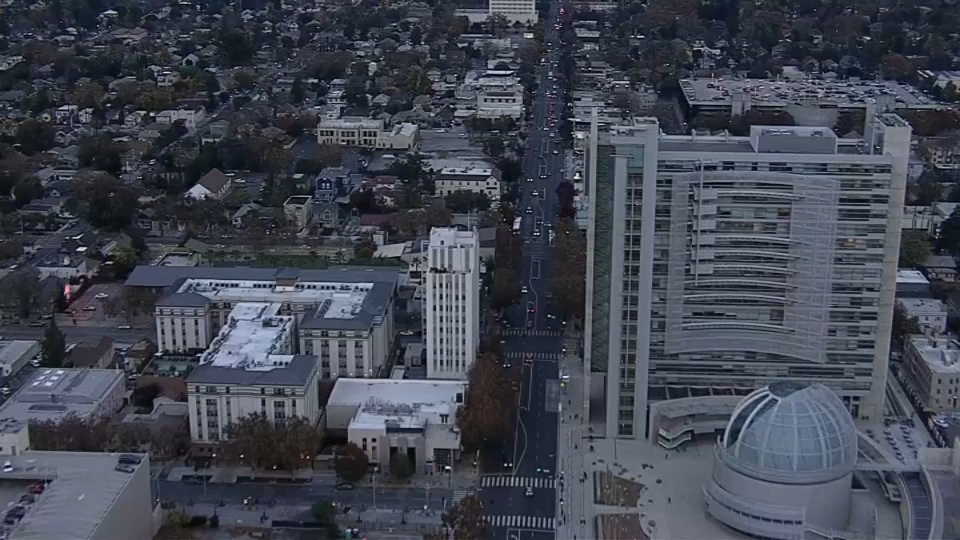

A new report from research company Clever Real Estate names San Jose as the “worst place for prospective home buyers” in the nation. The report added people are better off renting in San Francisco or San Jose than purchasing a home.

Data about monthly mortgage rates in San Jose only reinforces the sense of hopelessness facing South Bay millennials who dream about buying a home in the city.

Kevin Mahoney and his partner said it’s difficult enough just paying rent, even with two incomes. They’ve pretty much given up on buying a home.

“I have friends who are my same age, and they’re still living two and three people to a house to try and afford the rent,” said Mahoney.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

The average new monthly mortgage in San Jose is $9,372, according to Clever Real Estate. In contrast, the average rent is less than $3,200.

Neil Collins, the head of the Santa Clara County Association of Realtors, said he knows trying to break into the Bay Area housing market is a daunting scenario. Still, he told NBC Bay Area his agents are finding plenty of buyers, although there aren’t a lot of homes for sale.

“On the buyer’s side, they’ve accepted where rates are, and there is still very high demand out there, so we are looking at a bit of an inventory crunch right now,” said Collins.

It’s that inventory crunch which has helped keep prices high in the South Bay, even as interest rates have climbed from 3% to 7% over the past two years.

Rakesh Rajappa bought a three bedroom, three bath San Jose home in 2020. He told NBC Bay Area he sometimes has buyer’s remorse, even at the lower interest rate.

“I do have second thoughts. Was it cheaper just to rent?” said Rajappa. “Or is it worth buying a house?”

Rajappa added he can’t imagine how new home butters are doing it. The floor plan he bought two years ago for less than a million dollars is now selling for 1.1 million with interest rates at double what he pays.

“We’ve been looking to move out of the state, frankly,” said Mahoney. “Because we just can’t afford to live here.”

But real estate experts advise, if you have the money, it’s still better to buy rather than pay rent on someone else’s property.

“It’s just an opportunity for you to secure your destiny when it comes to housing security,” said Collins.