-

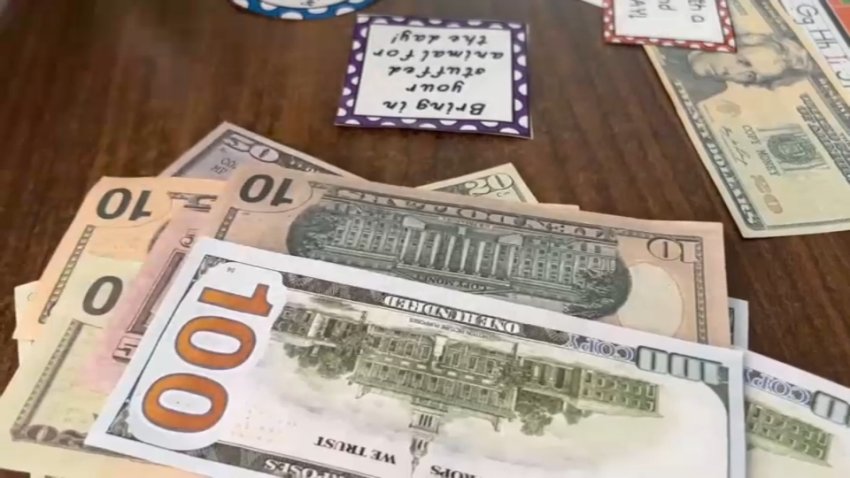

Watch: Experts say get kids involved early when talking finances

It’s a big week in lots of households with the tax deadline, but wealth experts say conversations about finances should hardly be limited to adults. We have tips for getting the kids involved.

-

The income everyday Americans earn in every U.S. state — see how your salary measures up

You don’t have to live on the coasts to make a solid income, but it may help.

-

Most people say their income tax refund is spent already

With the tax deadline fast approaching, new data shows a majority of taxpayers have already spent some or all of their tax refund money, according to Credit Karma. Meanwhile, 1 in 4 fear they won’t be able to afford their tax payment.

-

What Lewis Hamilton learned about retirement from Michael Jordan and Serena Williams

Lewis Hamilton is ‘serious’ about exploring his passions outside of racing.

-

People hate budgeting. Here's why — and how to reframe it

Budgeting often gives a sense of deprivation. There are ways to reframe the exercise more positively, experts said.

-

In the market for an electric vehicle? Here's why 2024 might be the year to buy

The Treasury Department has made the new clean vehicle tax credit much easier to obtain this year.

-

I built a 296-square-foot backyard tiny home in Atlanta: What to know if you want to convert a $5,000 shed from Costco

It’s not easy to convert a shed from Costco or Amazon into a livable space, says Precious Price, who built a tiny home in her backyard and now advises others.

-

34-year-old making $49,000 a month in passive income: What I always tell people who want to build successful side hustles

“Stop believing these 3 myths,” writes entrepreneur Ryan Hogue, if you want to be successful at starting a passive income stream or a side hustle.

-

The 16 worst-paying college majors, five years after graduation

Liberal arts majors can make just $38,000 in the first five years after graduation, which is below the national median for all workers.

-

Former 6-figure tech worker earns $22K baking pastries in France—how much her life abroad costs

Valerie Valcourt changed careers and moved abroad in her 30s.

-

Raising your credit score can help you save $92 per month, report finds. Here are some expert tips

Improving your credit score can be one way to save as inflation continues to prompt higher prices.

-

Self-made millionaire: If you love it, buy the Stanley cup—it's ‘not the reason you're financially struggling'

On her way to stashing $100,000 at age 25, Tori Dunlap learned saving money doesn’t have to mean depriving yourself.

-

Biden administration proposes capping bank overdraft fees to as low as $3

Under the proposed rule, banks could only charge customers what it would cost them to break even on providing overdraft services.

-

With rate cuts on the horizon, here are 4 of the best places for short-term savings in 2024

With interest rate cuts expected in 2024 from the Federal Reserve, experts cover the best savings options for short-term cash. Here’s what to know.

-

Your loved ones may be eligible for a one-time Social Security payment when you die. Here's what to know

Social Security retirement benefits provide guaranteed income for your lifetime. Here’s how that money may benefit your family after you die.

-

The secret life of gift cards: Here's what happens to the billions that go unspent each year

While it may take gift cards years to expire, experts say it’s still wise to spend them quickly.

-

48-year-old American who quit teaching now lives in Mexico on $38,000/year — and works just 15 hours a week

Adalia Aborisade went from working 60 hour weeks as a public school teacher to just working around 15 hours a week as an entrepreneur living in Mexico City.

-

3 ways to cut your grocery bill, from a ‘cash stuffing' expert who's on track to pay off $70,000 in 3 years

Baddies and Budgets founder Jasmine Taylor says one of the first questions her followers ask her these days is how to trim their food expenses.

-

Here's what Mark Cuban would do with just a phone and $500 in cash: ‘That is the best question I have ever been asked'

If billionaire Mark Cuban needed to rebuild his fortune from scratch, he knows exactly what he’d do. Step 1, he says: Land the first sales job he can get.

-

Want to retire at 65 with $2 million? Here's how much to save each month

Most Americans hope to retire as millionaires, Bankrate reports. Here’s how much to set aside each month to save $2 million by the time you turn 65.