If you're in your 40s and have over $40,000 saved for retirement, you're ahead of most people in your age bracket. However, you may need to take some proactive steps in order to retire comfortably.

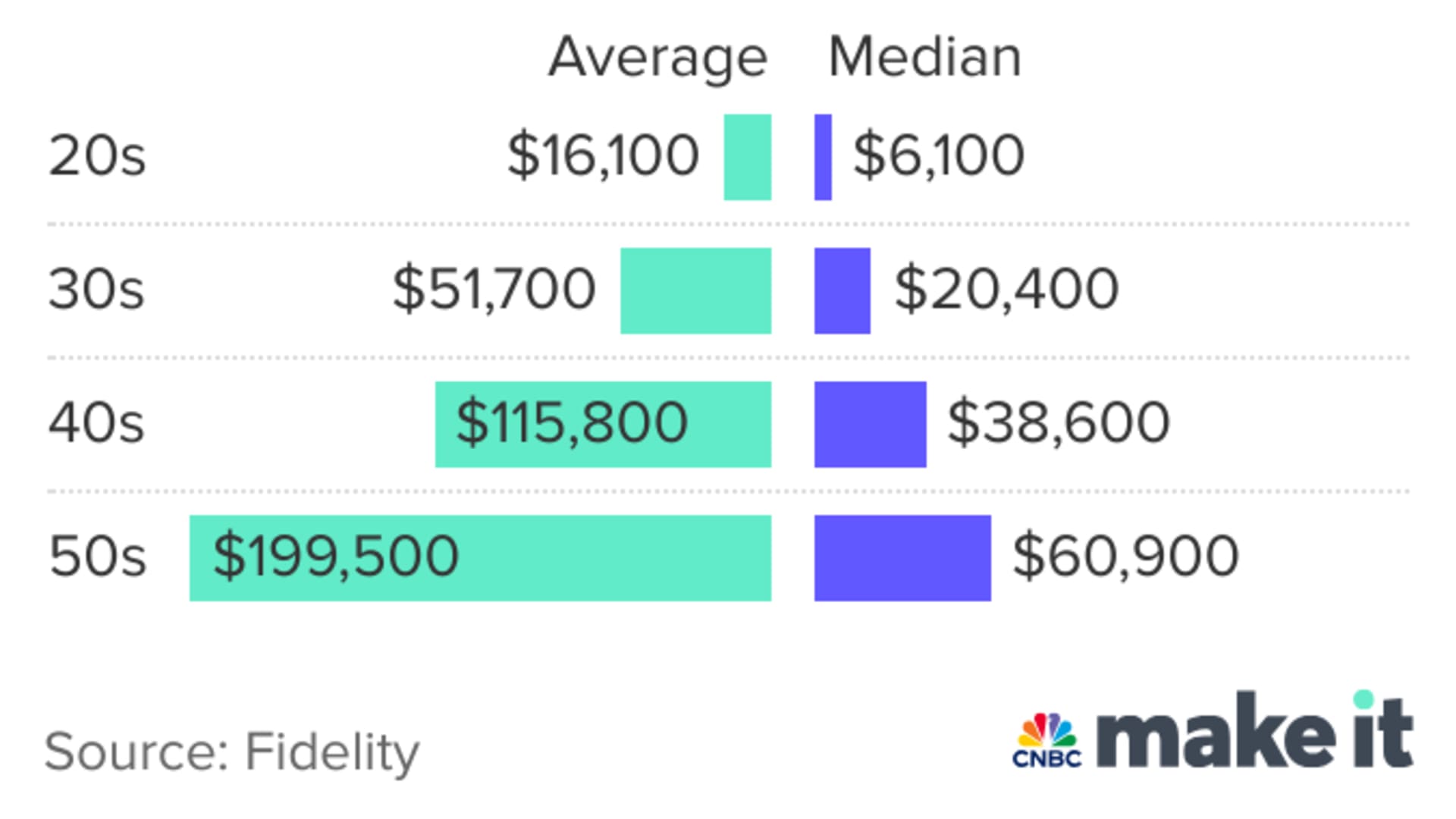

The median 401(k) balance for Americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from Fidelity Investments, the nation's largest 401(k) provider. That means half of account holders in this age range have savings above this balance and half have savings below it.

Here's how much Americans have in their 401(k)s by age, according to Fidelity.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

For people in their 40s who hope to retire in their 60s, retirement is edging closer each year. However, they're likely a long way off from their savings goals.

By the time you reach your 40s, you should aim to have three times your salary saved for retirement, according to Fidelity's guidelines. If you earn $80,000 annually, you'd ideally have $240,000 saved for your post-work years.

Why Americans in their 40s haven't been able to save more

Money Report

Various factors have gotten in the way of this age cohort's ability to boost their retirement contributions.

For one, when many people in their 40s were beginning their careers, they didn't get a chance to benefit from reforms to the tax system, such as auto-enrollment, which automatically enrolls you into your employer's 401(k) plan, and auto-escalation, which automatically ups your savings rate by a given percentage or dollar amount annually, says Anne Lester, a retirement expert and author of "Your Best Financial Life: Save Smart Now for the Future You Want."

"They were not the beneficiaries of all of the reforms that have happened in the 401(k) system in the last 15 years," she tells CNBC Make It. "Many Gen Xers have changed jobs, and maybe they're now contributing, but they missed out on saving in those early years if they didn't sign up themselves."

On top of that, many people in their 40s may find themselves in the "sandwich generation," covering expenses related to both child care and taking care of aging parents.

"It just takes a huge bite out of your wallet," Lester says. "I think as people are inevitably allocating scarce and finite resources, you may find yourself contributing less than you should."

How people in their 40s can boost their retirement savings

If you're in your 40s and your retirement savings aren't where you'd like them to be, there are a couple of ways to get on track.

First, gain a clear understanding of where your retirement savings stand and what factors are within your control. Despite your contributions, your overall account balance can be impacted by things such as market volatility.

On the other hand, your savings rate, which is the percentage of your income you allocate toward your retirement investment accounts, is within your control.

That's why you should make sure you're contributing enough to get your company's full match, if available. Fidelity recommends aiming for a savings rate of 15%, including any employer match.

If you're behind on your retirement savings, you may need to make some short-term sacrifices so that you can contribute even more in order to make up for any missed years, Lester says.

"I'm not saying it's going to be easy," she says. "If you're in your 40s and have saved zero for retirement, you may be looking at a savings rate of 30-plus percent."

But this doesn't have to be done all at once. You can use features like auto-escalation to increase your retirement savings rate by a few percentage points each year until you reach your goal.

Additionally, as expenses related to things like caring for young children decrease, you can allocate that money toward your retirement.

"Those expenses will drop off at some point and then you've got to redirect that money into savings," Lester says. "Mentally plan for that now so that you're not feeling poor or deprived when you get that a little bit of extra money."

Want to make extra money outside of your day job? Sign up for CNBC's new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Register today and save 50% with discount code EARLYBIRD.

Plus, sign up for CNBC Make It's newsletter to get tips and tricks for success at work, with money and in life.