States facing revenues in sharp decline amid the coronavirus pandemic have tough choices ahead – and you might be shelling out more in state and local taxes as a result.

State and local governments were left out of the $484 billion coronavirus relief bill that President Donald Trump signed into law last week.

"Our costs are going up, serving folks who have lost their jobs, small businesses that have been crushed, folks who are in the health-care system," said New Jersey Gov. Phil Murphy in a Monday morning interview on CNBC’s "Squawk Box."

"Our revenues have fallen off the table," he said.

Jurisdictions that are scrounging for money amid COVID-19 can tap their rainy day fund, if it’s available. They can also drastically cut services to their constituents or find ways to boost taxes.

"We’re hopeful for federal aid, but if it doesn’t come through or it isn’t up to the magnitude of the gaps that emerge, then states will have to balance their budgets," said Nick Johnson, senior vice president for state fiscal policy at the Center on Budget and Policy Priorities.

Revenue in decline

U.S. & World

Lockdown orders and layoffs deprive states and localities of two valuable sources of revenue: income taxes and sales taxes.

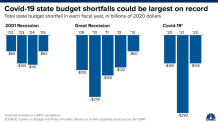

States are expected to run a $105 billion deficit, in aggregate, for the 2020 fiscal year as COVID-19 puts a dent into their finances, according to estimates from the Center on Budget and Policy Priorities.

The majority of states – 46 of them – will kick off their 2021 fiscal year on July 1, 2020. The pain is expected to continue.

Aggregate state budget deficits are expected to reach $209 billion in the 2021 fiscal year, the Center forecasted.

Where taxes could rise

Here’s where you might see states and localities boost taxes as they scramble for additional revenue:

• Corporate income taxes: If you normally commute to a neighboring state to work, your home state may want its slice of the income you’re generating while you work from your living room.

In this case, your home state could argue that your employer has a presence there and is responsible for state taxes.

A handful of jurisdictions (Indiana, Mississippi, New Jersey, Pennsylvania and Washington, D.C.) are giving corporations a pass on this issue due to Covid-19. But be aware of how your state proceeds.

• Online purchases: A Supreme Court decision in 2018 opened the floodgates for states to require online merchants to collect and remit sales taxes.

"Most states have set the threshold at 200 transactions and $100,000 in sales," said Andrew Moylan, executive vice president of the National Taxpayers Union Foundation. “You could see states start to push those numbers down.”

• Excise and sales taxes: States may view your on line viewing habits as a source of funding.

"Most digital services aren’t taxed, and that’s one thing states could look into," said Lucy Dadayan, senior research associate at the Tax Policy Center.

Similarly, people may be locked up in their homes, but they’re still buying goods online: Rates on sales taxes may rise.

• Property taxes: Towns and cities, rather than states, handle property taxes and could depend on them even more.

"Property tax is the most stable tax in a recession, especially right now when assessment values haven’t changed," said Jared Walczak, director of state tax policy at the Tax Foundation.

The worry there is whether more people will miss those property tax payments — as well as their mortgage payment — if the current unemployment situation gets worse.

• Gross receipts taxes: Finally, more states could decide to tax businesses based on their gross receipts — that is, their total revenues before deducting expenses.

"You can see the appeal to revenue officials in that you don’t have to rely on a business being profitable to impose taxes," said Moylan.

Delaware, Nevada, Ohio, Texas and Washington state all have gross receipts taxes.

This story first appeared on CNBC.com. More from CNBC:

How are unemployment benefits taxed?

The PPP ran out, and these businessowners were shut out

Why you should pay those old tax bills immediately