Stocks rose on Tuesday as Wall Street assessed the latest batch of corporate earnings and the timeline for rate cuts from the Federal Reserve.

The S&P 500 rose 0.23% to settle at 4,954.23, while the Nasdaq Composite inched up 0.07% to close at 15,609.00. The Dow Jones Industrial Average jumped 141.24 points, or 0.37%, to end at 38,521.36.

"The market is trying to make heads and tails out of Powell's statement" and the latest earnings, said Adam Sarhan, CEO of 50 Park Investment, referring to recent comments from Fed Chair Jerome Powell that dashed hopes for a March cut.

Palantir Technologies surged nearly 31% after the company posted a revenue beat in the fourth quarter, while Spotify Technology gained nearly 4% after topping expectations and posting an increase in Premium subscribers.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

Expectations for fast-approaching cuts, combined with strong earnings from the technology behemoths, have contributed to the market's push higher in recent weeks. However, recent remarks from Federal Reserve Chair Jerome Powell dashed hopes for a March rate cut and indicated that cuts may come much later than previously expected.

Narrow market leadership in recent sessions has also heightened concerns over whether the market can sustain the rally without broader participation.

"We're on the precipice of some real volatility in the marketplace, and the last two days are very indicative of what's to come here for at least the next six to eight weeks," said Philip Blancato, CEO of Ladenburg Thalmann Asset Management.

Money Report

Tuesday marks around the halfway point of the earnings season, with reports from Amgen, Chipotle Mexican Grill and Ford after the bell.

Stocks close higher, Dow jumps 140 points

Stocks finished higher on Tuesday, with the Dow Jones Industrial Average jumping 141.24 points, or 0.37%, to end at 38,521.36. The S&P 500 rose 0.23% to settle at 4,954.23, while the Nasdaq Composite inched up 0.07% to close at 15,609.00.

— Samantha Subin

Bitcoin rises as the 10-year Treasury and regional banks fall

The price of bitcoin rose 2% in afternoon tradin, pulling crypto related equities up with it.

Crypto exchange Coinbase gained more than 2%, while bitcoin proxy Microstrategy added 1.8%. Riot Platforms and Marathon Digital, the largest of the bitcoin miners, gain 4% and 3%, respectively.

The move in bitcoin coincided with a decline in the 10-year Treasury yield, which added to concerns about U.S. regional banks. New York Community Bancorp fell more than 20% Tuesday, extending a sell-off that began Wednesday. The Invesco KBW Regional Banking ETF lost 1.5%. Last year's regional banking crisis proved to be a positive catalyst for bitcoin as investors who lost confidence in the banks turned to the cryptocurrency as a hedge against uncertainty.

Elsewhere in crypto, ether jumped more than 4%, lifted in part by bitcoin. It got a boost earlier in the day as investors rotated out of the coin tied to the Solana network, which suffered a brief outage in the morning.

— Tanaya Macheel

Oil prices settle higher as U.S. production expected to plateau

Oil prices rose Tuesday as U.S. domestic crude production is expected to plateau this year after setting a record in 2023.

The West Texas Intermediate contract for March added 53 cents, or 0.73%, to settle at $73.31 a barrel. The Brent contract for April was settled at $78.59 a barrel, up 60 cents, or 0.77%.

U.S. crude output set a record of 13.3 million barrels per day in December before pulling back to 12.6 million bpd in January due to winter storms, according to data released by Energy Information Agency.

Domestic production will briefly return 13.3 million bpd in February but then decline through the middle of the year, according to the EIA. The U.S. will not exceed the production record of 13.3 million bpd until February 2025.

Record U.S. crude production has weighed on oil prices for months as traders worry that that the market is oversupplied amid a faltering economy in China.

— Spencer Kimball

John Hancock's Roland recommends diversifying amid narrow market breadth

Investors may want to consider diversifying as market breadth narrows to a handful of popular megacap stocks again, said John Hancock Investment Management's Emily Roland.

"We like quality and tech is the poster child for quality, but we are concerned about the valuations," the co-chief investment strategist said. "We do think it's important to consider diversifying."

While continued earnings growth from these companies would support their heightened valuations, Roland is finding opportunity in midcaps, industrials and healthcare.

"We're not surprised the quality has been rewarded and we're certainly not surprised that you're seeing the strongest relative earnings trends in some of those larger cap tech names," she said. "The question just becomes when does that contribute to overvaluation."

— Samantha Subin

Sell Nvidia bonds, Barclays says

Mounting competition and risks in China means investors may want to take a bearish stance of Nvidia bonds, according to Barclays.

To be sure, the firm maintains an outperform rating on the stock put initiated coverage of Nvidia bonds with an underweight rating.

"NVDA valuations fully price in the AI GPU growth ramp, and we expect demand growth to eventually moderate as we move from training into the inference phase," wrote Sandeep Gupta.

He expects Nvidia to face rising competition from peers and hyperscaler silicon ventures, along with Intel and Advanced Micro Devices. This could weaken the long-term trajectory for graphics processing units.

"While we acknowledge that demand for Nvidia's advanced GPUs remains unabated, we are taking a view on the long-term sustainability of this demand as well as how the market is pricing this anticipated growth in NVDA bond spreads," Gupta wrote.

Given the risk to the downside, he recommends "selling NVDA 3.5% 2050s (54bp, $82) and buying AMD 4.393% 2050s (71bp, $93) to pick 17bp of spread, while paying $11 points, and moving into a future AI GPU share-gainer."

— Samantha Subin

NYCB drops another 20%

Shares of New York Community Bancorp plunged another 20% Tuesday, following a 42% loss last week.

The Hicksville, N.Y.-based regional bank has lost more than half of its value since last Tuesday when reported a fourth-quarter loss. It also took a $552 million provision for credit losses and cut its dividend to shore up capital.

NYCB took over the failed Signature Bank during the regional bank crisis in 2023.

— Yun Li

Transportation ETF rises to highest level since 2022

The iShares Transportation Average ETF (IYT) touched its highest level in more than a year on Tuesday.

The fund added more than 2% in afternoon trading. With that gain, the ETF hit a point last seen in April 2022.

Spirit Airlines led the fund up with a gain of nearly 13%. Hertz was the next best performer at 8% higher, followed by Allegiant, ArcBest and Avis at more than 7% up each.

All stocks in the ETF were trading higher in the session.

— Alex Harring

Earnings up more than 8% year over year so far

With just over half of S&P 500 companies having reported earnings for the previous quarter, here's where this season stacks up, according to LSEG.

- Earnings are up 8.1% year over year

- Earnings are beating analyst expectations by 6.3%

- Revenue is up 3.2% year over year

- Revenue has topped expectations by 1.3%

— Jesse Pound, Robert Hum

Stocks making the biggest moves midday

Check out the companies making headlines in midday trading.

- Palantir — Shares of the data analytics provider surged more than 24% after the company reported $608.4 million in revenue for the quarter, versus the $602.4 million expected by analysts surveyed by LSEG. Guidance for 2024 was about in line with expectations.

- Coherent — Shares jumped 17% after Coherent posted stronger-than-expected quarterly results. In its second quarter, the materials company posted earnings of 36 cents per share, greater than the 26 cents per share anticipated by analysts polled by StreetAccount. Revenue of $1.13 billion edged out a consensus estimate of $1.12 billion.

- GE Healthcare Technologies — GE Healthcare Technologies shares jumped more than 11% following better-than-expected earnings results. In its fourth quarter, the medical technology company reported adjusted earnings of $1.18 per share, more than the earnings of $1.07 per share expected by analysts polled by FactSet. Revenue of $5.21 billion topped the $5.09 billion consensus estimate.

— Sarah Min

Overseas markets positioning for a 'value renaissance,' says porfolio manager

Although foreign stocks should trade at 'some discount' to U.S. equities, they're currently trading at nearly "all-time low valuation differentials," according to Harris Associates portfolio manager David Herro.

"Value exists for value investors; companies with valuable quality business that generate a good strong cash flow stream," Herro told CNBC's "Squawk on the Street" on Monday.

The investor highlighted the German market, which he cited as having grown 11 times free cash flow yields over the U.S. market. While overseas stocks typically trade at around an 8% to 9% discount relative to U.S. stocks, the discount is now pushing "a couple standard deviations," per Herro.

"If you look outside the United States, in particularly in Europe, you're able to find extremely high quality well managed businesses that trade up ridiculously, almost all time low valuation differential," Herro added.

— Hakyung Kim

Fed's Mester sees 'gradual' pace of rate cuts this year

Cleveland Federal Reserve President Loretta Mester on Tuesday became the latest central banker to advocate a patient approach to cutting interest rates this year.

Like several other officials who have spoken recently, Mester said she's not ready to start easing policy until she gains more confidence that inflation is on a stable path towards the Fed's 2% goal. Having a strong economy allows policymakers to hold off on any dramatic moves, she added.

"If the economy evolves as expected, I think we will gain that confidence later this year, and then we can begin moving rates down," Mester, a voting member this year on the rate-setting Federal Open Market Committee, said in prepared remarks for a speech in her home district. "My base case is that we will do so at a gradual pace so that we can continue to manage the risks to both sides of our mandate."

Markets have moved back expectations for the first cut to May, with five total quarter percentage point moves lower priced in, according to the CME Group's FedWatch futures gauge.

—Jeff Cox

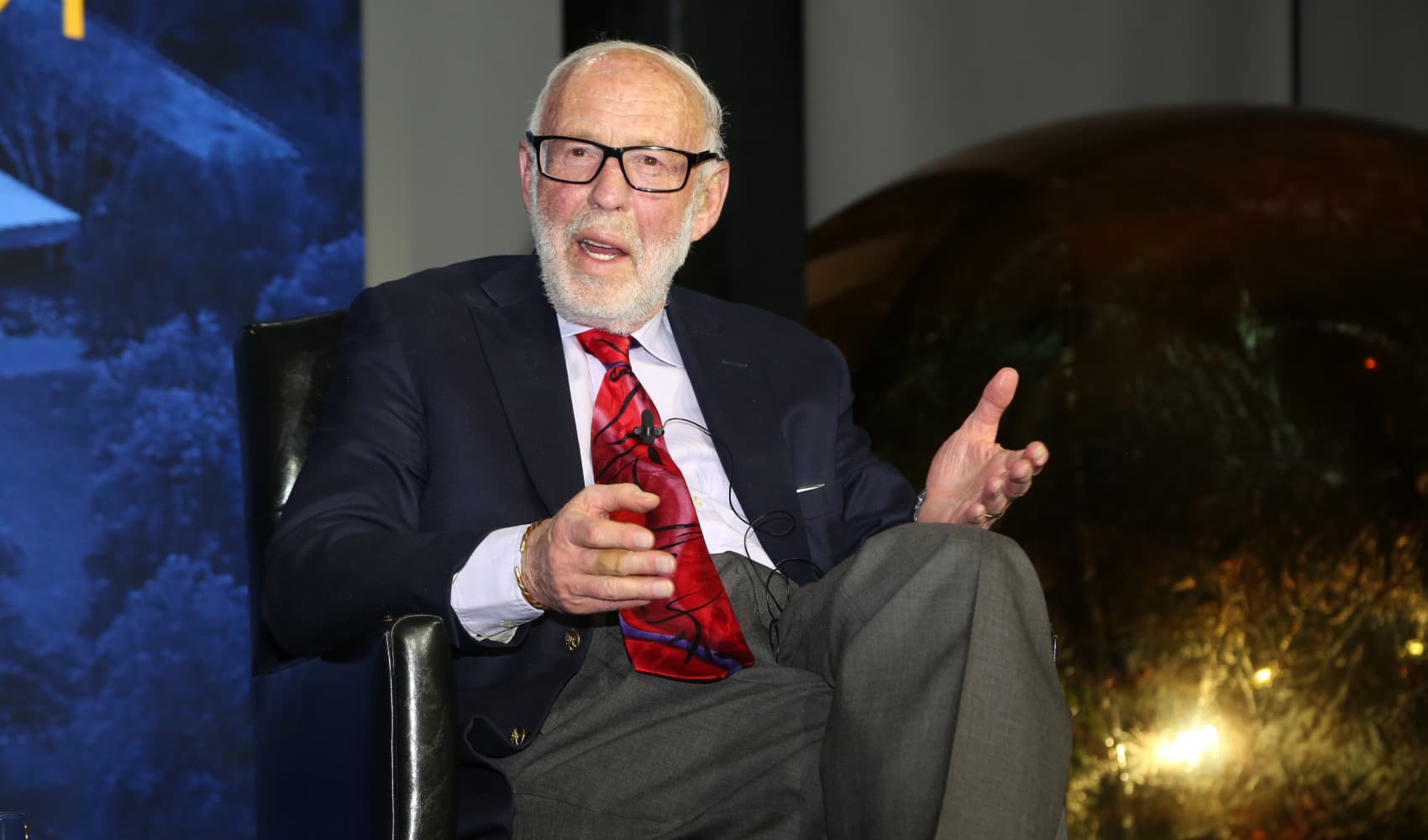

Leon Cooperman says ‘too rich’ stocks to go down this year

Billionaire investor Leon Cooperman forecasts that stocks could see losses this year, while long-duration Treasury yields could test higher again.

"Everybody came into 2023 with a very negative view, and the market went up quite a bit. Everybody is now positive, and so my guess is that by the end of the year, maybe we will go down," Cooperman said Tuesday on CNBC's "Squawk Box." "You see the market multiple 21 times. It seems too rich to me."

The chair and CEO of the Omega Family Office said investors have been too optimistic about the number of rate cuts the Federal Reserve will enact this year. He thinks the central bank may not slash short rates enough to satisfy investors.

— Yun Li

Palantir on track to see second best session ever

Palantir shares headed for their second best session ever as investors analyzed the positive impact of artificial intelligence on the software company.

Shares jumped nearly 24% in Tuesday's session around 11 a.m. ET. That put the stock on pace for its second biggest gain in a session ever and best day since 2022.

Tuesday's rally comes a day after Palantir recorded $608.4 million in revenue for the fourth quarter, beating the estimate of $602.9 million from analysts polled by FactSet. The company said it continues to see high demand for large language models and is scaling up its AI platform.

That helped investors overlook the fact that per-share earnings came in line with analyst expectations at 8 cents. While Palantir issued current-quarter revenue guidance that was below the forecast of analysts surveyed by FactSet, it exceeded expectations for the measure in the full year.

— Alex Harring, Ashley Capoot

China stocks bounce as Shanghai stock market posts best day in nearly two years

A handful of U.S.-listed China stocks bounced on Tuesday as the Shanghai Stock Exchange bounced more than 3% for its best day since March 16, 2022.

VNET Group was one of the biggest gainers of the group, surging more than 14%. Xpeng added 9%, while Li Auto and Bilibili rocketed at least 8% higher. JD.com and Autohome edged up about 6% and 11%, respectively.

The iShares China Large-Cap ETF, iShares MSCI China ETF and Xtrackers Harvest CSI 300 China A-Shares ETF all jumped more than 4%. The KraneShares CSI China Internet ETF gained nearly 6%.

Elsewhere, the Hang Seng closed up 4.04% for its best day since July 25, 2023, while the China Shenzhen closed up 5.14% for its best day since Feb. 25, 2019.

— Samantha Subin, Gina Francolla

What UBS says market response to labor data shows

The market's strong reaction to Friday's better-than-expected jobs report can offer two key insights, according to UBS.

Analyst Maxwell Grinacoff told clients on Tuesday that the market is starting to accept that good economic news can also mean good news for the stock market. That's because the Federal Reserve may no longer need data showing cooling in the economy to justify interest rate cuts.

Additionally, he said low-quality stocks not taking a leg up can signal that the momentum trade hasn't yet ended.

— Alex Harring

S&P 500 opens slightly higher

The S&P 500 opened slightly higher on Tuesday, rising 0.25%. The Nasdaq Composite gained 0.3%, while the Dow Jones Industrial Average inched down 10 points.

— Samantha Subin

These are the stocks making the biggest moves premarket

Check out the companies making headlines before the bell.

- Spotify — The streaming stock popped 7.9% after Spotify reported an increase in Premium subscribers — which reached 236 million in the fourth quarter — that beat analysts' expectations as estimated by the FactSet consensus.

- Palantir — Shares of the data analytics provider surged 21% after the company on Monday reported $608.4 million in revenue for the quarter, versus the $602.4 million expected by analysts surveyed by LSEG. Earnings and guidance for 2024 was about in line with expectations.

- Eli Lilly — The drug maker saw its shares rise 5% after it blew past analysts' estimates for the fourth quarter thanks to the strong launch of its weight loss drug Zepboud and higher prices for its diabetes drug Mounjaro.

For the full list, read here.

— Pia Singh

DocuSign announces layoffs

DocuSign announced a restructuring plan on Tuesday that will result in layoffs for about 6% of its workforce.

The majority of the layoffs will come from DocuSign's sales and marketing units, the company said.

DocuSign also said that it expects to meet or exceed its financial guidance for the fifth quarter.

— Jesse Pound

Fed and economy are 'show me' stories, says Wolfe Research's Senyek

Wolfe Research is bracing for the market to continue its grind higher until the Federal Reserve, or the economy, breach expectations.

"We continue to believe that the Fed and economy are 'show me' stories, and that the overall U.S. equity market is likely to push higher until there's compelling evidence that the Fed won't cut in-line with expectations and/or the growth outlook decelerates enough to spark recession fears," wrote Chris Senyek in a Tuesday note.

"While it's not our intermediate-term base case, if consensus is correct and the fed cuts at the same time U.S. economic growth remains solid, we'd expect the recent rally to broaden out," he added.

Looking ahead, Senyek views small cap outperformance as a likely "catch up trade" should this outcome unfold, noting that the small-cap indices sit well below all-time highs but look attractively valued.

— Samantha Subin

Eli Lilly rises after earnings

Eli Lilly shares rose more than 2% in the premarket after the company posted better-than-expected quarterly results, driven by strong Mounjaro revenue.

The company earned an adjusted $2.49 per share on revenue of $9.35 billion. Analysts polled by LSEG expected a profit of $2.22 per share on revenue of $8.93 billion. Revenue for Mounjaro came in at $2.2 billion.

Lilly also issued better-than-expected revenue guidance for the full year.

— Fred Imbert

China and Hong Kong stocks surge 2% as healthcare, tech firms gain

Mainland Chinese and Hong Kong equity benchmarks surged 2% on Tuesday, led by healthcare and tech stocks, respectively.

This comes after the Chinese regulators took measures to calm a recent sell-off in markets, including a statement from the country's securities and regulatory commission that said it would "guide institutional investors ... to enter the market with greater efforts."

The largest mover on the CSI 300 was Beijing Wantai Biological Pharmacy Enterprise, which soared 10%, while the biggest gainer on the Hang Seng index was tech giant Alibaba, whose shares jumped 5.9%.

— Lim Hui Jie

Stocks making the biggest moves after hours

Check out the companies making headlines after hours.

Palantir Technologies — Shares jumped 19.5% after Palantir posted a revenue beat in the fourth quarter. Revenue came in at $608.4 million versus the $602.4 forecast by analysts, according to LSEG, formerly known as Refinitiv. The company posted adjusted earnings of 8 cents per share, which was in line with analysts' expectations. CEO Alex Karp also highlighted the growth in the company's artificial intelligence platform.

NXP Semiconductors — The chipmaker gained more than 3% following stronger-than-expected fourth-quarter results. NXP announced adjusted earnings of $3.71 per share, which was 8 cents above estimates from analysts polled by LSEG. The company's revenue of $3.42 billion also beat analysts' forecasts of $3.40 billion.

Chegg — The stock declined 1% after revenue guidance for the first quarter came in lighter than expected. Meanwhile, the company posted adjusted earnings per share that were in line with analysts' expectations and a revenue beat in the fourth quarter, per LSEG.

The full list can be found here.

— Hakyung Kim

Stock futures little changed Monday

U.S. stock futures open near the flatline Monday.

Futures tied to the Dow Jones Industrial Average slipped 14 points, or 0.04%. S&P 500 futures inched down 0.03%, while Nasdaq 100 futures added 0.05%.

— Hakyung Kim