- Federal Reserve officials say they have tools to fight inflation should it become a problem.

- Those tools, primarily rate hikes, have come with a cost in the past, plunging the U.S. into recession in the early 1980s.

- The Fed thinks “the strongest economic growth in nearly 40 years will generate almost no lasting inflationary pressure, which we suspect is a view that will eventually be proven wrong," said Andrew Hunter, senior U.S. economist at Capital Economics.

One of the main reasons Federal Reserve officials don't fear inflation these days is the belief that they have tools to deploy should it become a problem.

Those tools, however, come with a cost, and can be deadly to the kinds of economic growth periods the U.S. is experiencing.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

Hiking interest rates is the most common way the Fed controls inflation. It's not the only weapon in the central bank's arsenal, with adjustments to asset purchases and strong policy guidance also at its disposal, but it is the most potent.

It's also a very effective way of stopping a growing economy in its tracks.

The late Rudi Dornbusch, a noted MIT economist, once said that none of the expansions in the second half of the 20th century "died in bed of old age. Every one was murdered by the Federal Reserve."

Money Report

In the first part of the 21st century, worries are growing that the central bank might become the culprit again, particularly if the Fed's easy policy approach spurs the kind of inflation that might force it to step on the brake abruptly in the future.

"The Fed made clear this week that it still has no plans to raise interest rates within the next three years. But that apparently rests on the belief that the strongest economic growth in nearly 40 years will generate almost no lasting inflationary pressure, which we suspect is a view that will eventually be proven wrong," Andrew Hunter, senior U.S. economist at Capital Economics, said in a note Friday.

As it pledged to keep short-term borrowing rates anchored near zero and its monthly bond purchases humming at a minimum $120 billion a month, the Fed also raised its gross domestic product outlook for 2021 to 6.5%, which would be the highest yearly growth rate since 1984.

The Fed also ratcheted up its inflation projection to a still rather mundane 2.2%, but higher than the economy has seen since the central bank started targeting a specific rate a decade ago.

Competing factors

Most economists and market experts think the Fed's low-inflation bet is a safe one – for now.

A litany of factors is keeping inflation in check. Among them are the inherently disinflationary pressures of a technology-led economy, a jobs market that continues to see nearly 10 million fewer employed Americans than a decade ago, and demographic trends that suggest a longer-term limit to productivity and price pressures.

"Those are pretty powerful forces, and I'd bet they win," said Jim Paulsen, chief investment strategist at the Leuthold Group. "It may work out, but it's a risk, because if it doesn't work and inflation does get going, the bigger question is, what are you going to do to shut it down. You say you've got policy. What exactly is that going to be?"

The inflationary forces are pretty powerful in their own right.

An economy that the Atlanta Fed is tracking to grow 5.7% in the first quarter has just gotten a $1.9 trillion stimulus jolt from Congress.

Another package could be coming later this year in the form of an infrastructure bill that Goldman Sachs estimates could run to $4 trillion. Combine that with everything the Fed is doing plus substantial global supply chain issues causing a shortage of some goods and it becomes a recipe for inflation that, while delayed, could still pack a punch in 2022 and beyond.

The most daunting example of what happens when the Fed has to step in to stop inflation comes from the 1980s.

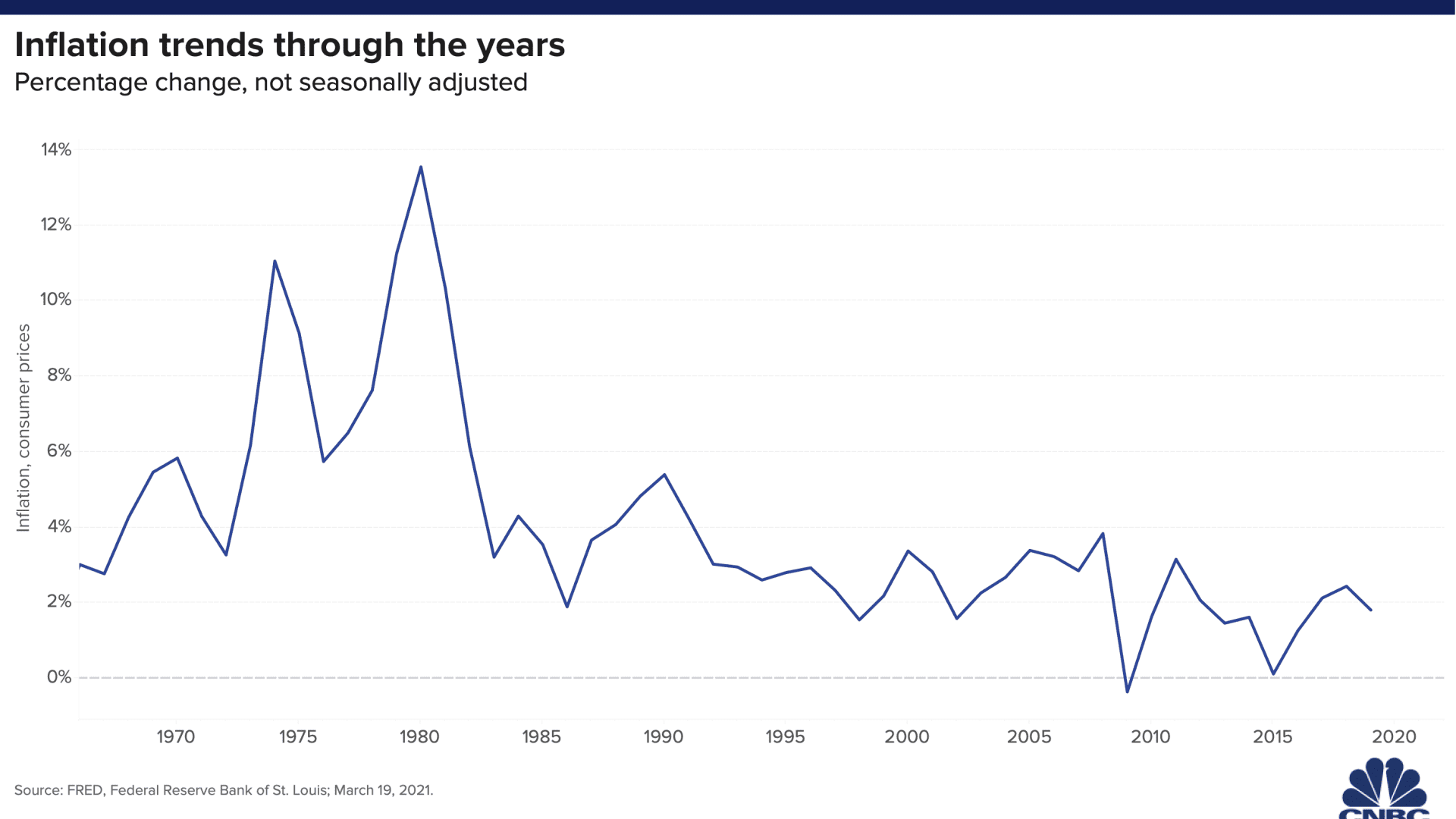

Runaway inflation began in the U.S. in the mid '70s, with the pace of consumer price increases topping out at 13.5% in 1980. Then-Fed Chairman Paul Volcker was tasked with taming the inflation beast, and did so through a series of interest rate hikes that dragged the economy into a recession and made him one of the most unpopular public figures in America.

Of course, the U.S. came out pretty good on the other side, with a powerful growth spurt that lasted from late -1982 through the decade.

But the dynamics of the current landscape, in which the economic damage from the Covid-19 pandemic has been felt most acutely by lower earners and minorities, make this dance with inflation an especially dangerous one.

"If you have to prematurely abort this recovery because we're going to have a kneejerk stop, we're going to end up hurting most of the people that these policies were enacted to help the most," Paulsen said. "It will be those same disenfranchised lower-comp less-skilled areas that get hit hardest in the next recession."

The bond market has been flashing warning signs about possible inflation for much of 2021. Treasury yields, particularly at the longer maturities, have surged to pre-pandemic levels.

That action in turn has raised the question of whether the Fed again could become a victim of its own forecasting errors. The Jerome Powell-led Fed already has had to backtrack twice on sweeping proclamations about long-term policy intentions.

"Is it really going to be all temporary?"

In late-2018, Powell's statements that the Fed would continue raising rates and shrinking its balance sheet with no end in sight was met with a history-making Christmas Eve stock market selloff. In late 2019, Powell said the Fed was done cutting rates for the foreseeable future, only to have to backtrack a few months later when the Covid crisis hit.

"What happens if the healing of the economy is more robust than even the revised projections from the Fed?" said Quincy Krosby, chief market strategist at Prudential Financial. "The question for the market is always, is it really going to be all temporary?'"

Krosby compared the Powell Fed to the Alan Greenspan version. Greenspan steered the U.S. through the "Great Moderation" of the 1990s and became known as "The Maestro." However, that reputation became tarnished the following decade when the excesses of the subprime mortgage boom triggered wild risk-taking on Wall Street that led to the Great Recession.

Powell is staking his reputation on a staunch position that the Fed will not raise rates until inflation rises at least above 2% and the economy achieves full, inclusive employment, and will not use a timeline for when it will tighten.

"They called Alan Greenspan 'The Maestro' until he wasn't," Krosby said. Powell "is telling you there's no timeline. The market is telling you it does not believe it."

To be sure, the market has been through what Krosby described as "squalls" before. Bond investors can be fickle, and if they sense rates rising, they'll sell first and ask questions later.

Michael Hartnett, the chief market strategist at Bank of America, pointed to multiple other bond market jolts through the decades, with only the 1987 episode in the weeks before the Oct. 19 Black Monday stock market crash having "major negative spillover effects."

He doesn't expect the 2021 selling to have a major impact either, though he cautions that things could change when the Fed finally does pivot.

"Most [selloffs] are associated with a strong economy and rate hikes from the Fed or were a rebound coming out of a recession," Hartnett wrote. "These episodes underscore low risks today, but rising risks when the Fed finally capitulates and starts hiking."

Hartnett added that the market should trust Powell when he says policy is on hold.

"The economic recovery today is still in early stages and troublesome inflation is at least a year away," he said. "The Fed is not even close to hiking rates."