This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

Despite earning well over six figures, Clinton Stamper still looks for coupons for his food.

The 26-year-old tries to keep his food budget to $5 a meal and uses online discounts to lower the cost of restaurant outings and food delivery services.

The habit stems from his childhood. Stamper grew up in Rootstown, a suburb in Ohio, and was mostly raised by his mom after his parents divorced when he was around 6.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

Stamper remembers watching his mom, who worked as a newspaper reporter, make ends meet on a single income while also caring for his aunt, who had cancer. "We could barely afford food," he tells CNBC Make It. Back then, going to McDonald's was a treat, and meals from the dollar store were the norm.

Today, just a few years out of college, Stamper earns $270,000 as a software engineer for Google in Austin, Texas — but he's more laser-focused on counting every dollar that comes in and goes out than ever. Here's how he manages his money.

Post-grad lifestyle inflation

Money Report

Stamper began earning his own money in middle school by tutoring and selling things to classmates. He learned about basic economics playing the video game Runescape and developed a code that he sold to other players on forums, through crypto or in-game currency. He ended up making around $30,000 between his junior and senior year of high school.

It should have been enough to cover most of his college costs at The Ohio State University, along with academic and need-based scholarships. But he's the first in his family to graduate from college, he says, and didn't have a ton of guidance. Stamper ended up taking out $45,000 in student loans and used his gaming money for entertainment, furniture and other lifestyle expenses.

When he graduated in 2018 and took a six-figure job with Amazon in Phoenix, Stamper encountered more lifestyle inflation: He rented a house that was way too big for him and furnished it with things he barely used before leaving. "I acquired bad spending habits because I'd never encountered that much earning potential," he says.

Despite earning significantly more money than he'd ever seen in his life, he was still stressed about finances. "I was trying to fix my financial situation because I heard so many horror stories of debt crumbling people's lives, and I didn't want my student debt to do that," he says.

In 2019, he began reading, watching and listening to anything about personal finances he could get his hands on. His income didn't change, but he stopped spending outside of basic necessities and put as much of his paycheck as he could toward his debt, which he paid off by December 2021.

He's since saved two months of living expenses for emergencies, started investing and is focused on building his net worth.

How he spends his money

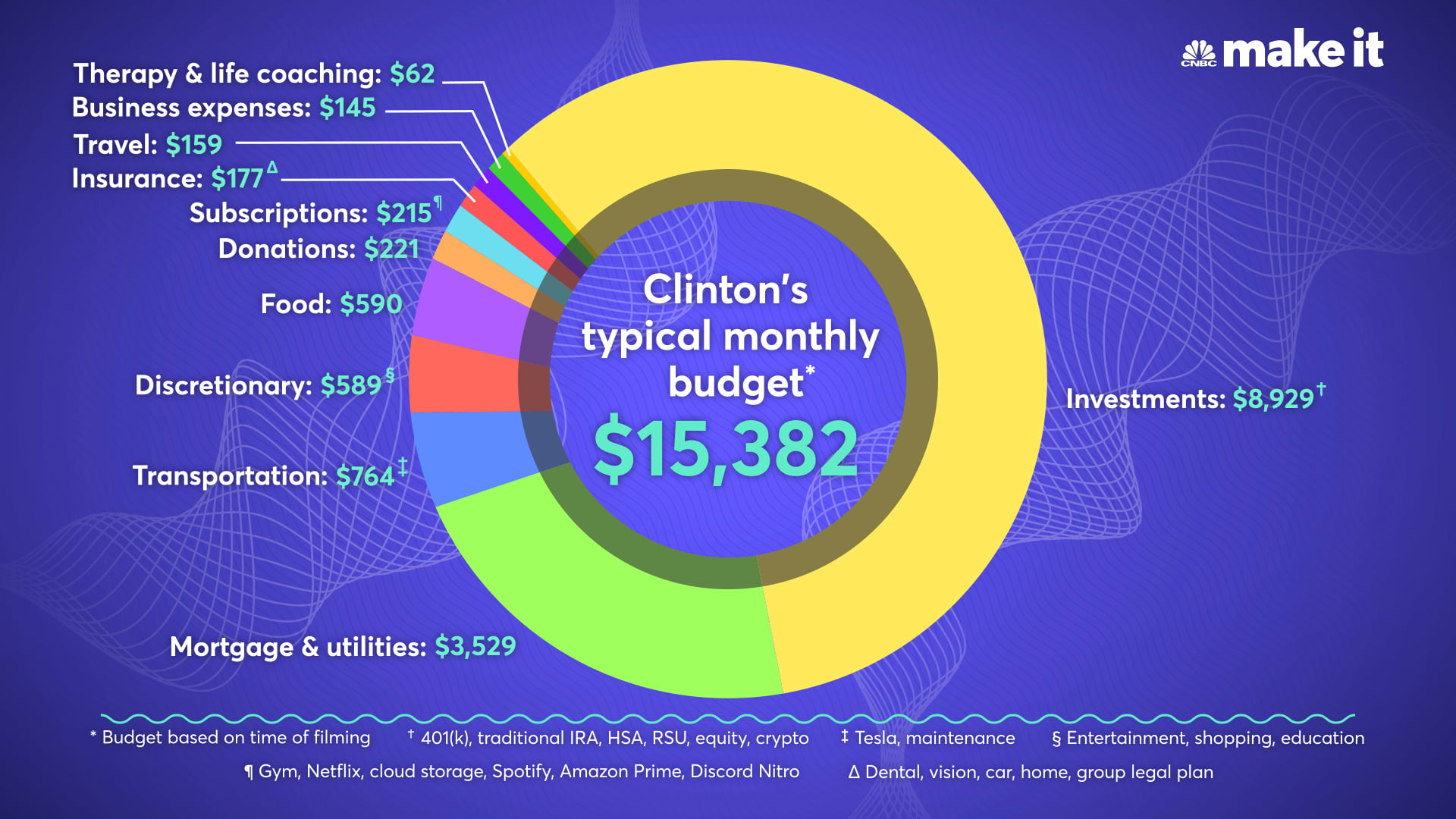

Here's a look at how Stamper typically spends his money, as of March 2022.

- Investments: $8,929 including contributions to his 401(k), traditional IRA, health savings account, stocks and cryptocurrency

- Mortgage and utilities: $3,529 for a 5-bedroom, 4-bathroom house

- Transportation: $764 for his Tesla payment and maintenance

- Discretionary: $589 for entertainment, shopping and education

- Food: $590

- Donations: $221 toward the National Multiple Sclerosis Society, Cheyanna Foundation for Children, Twitch

- Subscriptions: $215 for his gym, Netflix, cloud storage, Spotify, Amazon Prime, Discord Nitro

- Insurance: $177 for dental, vision, car, home, group legal plan

- Travel: $159

- Business expenses: $145 to create personal finance content on social media

- Therapy and life coaching: $62

These days, Stamper is meticulous about his finances. He pores over his spending in Mint every week and invests every day, earmarking $1,500 weekly for stock and crypto investing through Robinhood and WeBull.

Stamper also rolls his IRA contributions into a Roth IRA, which allows him to take advantage of the tax benefits of a Roth, even though his income exceeds the limit to contribute to one directly. This strategy is known as a "backdoor Roth."

On top of a competitive salary, Stamper says his work benefits help him cut a lot of everyday costs. Google pays for his phone and internet bills, subsidizes his gym membership and covers his health insurance premiums, though he pays for dental and vision care.

One of his favorite benefits is getting reimbursed for classes or trainings to learn new skills. He says Google will cover up to two-thirds of the cost, depending on if it's related to his job.

Right now, Stamper is learning to fly a paramotor, or a paraglider with a motor strapped to the back. He's still learning on the ground but hopes to be in the sky soon.

Buying a home during the pandemic

After investments, Stamper's biggest expense is his housing. In June 2021, he moved to the Austin area to take a new job with Google and decided to buy a home.

"Buying a house here was crazy," he says. Stamper and his girlfriend, Lexi Followill, 22, saw about 40 places, put in offers on three and waived every contingency they could.

"We had to write letters, we had to explain we weren't investors, we had to bid $50,000 to $60,000 over the list price," Stamper says.

In August 2021, he closed on a 5-bedroom, 4-bathroom house in Pflugerville, Texas, about a 30-minute drive from Austin, where things are a little cheaper, bigger and less competitive. He bought the place for $638,000 — $63,000 over asking — and put 10% down.

Stamper lives with Followill, who is a college student and dental assistant, as well as her sister, Katelin, 19, who works as a babysitter and will start college in the fall. He doesn't charge them for rent or utilities and says he would rather they spend that money on things like their education and other living expenses.

Looking ahead

Stamper eventually wants to bring his tech and financial savvy to the health-care field.

When Stamper was young and his aunt was sick, he and his mom would visit her at the Akron Children's Hospital. (She's since made a full recovery.) While there, Stamper became friends with a lot of other cancer patients around his age and became passionate about cancer research.

Stamper thought he'd become a neurosurgeon before his pivot to tech. He still hopes to contribute to cancer research and treatment in the future by funding developments in automated surgery. He spends about six hours a week reading up on artificial intelligence, and it's part of the reason he invests so aggressively — he hopes that in a few decades, he'll be able to lead or back a company developing this technology.

Robotic-assisted surgery exists, but he hopes automated surgery machines will enable a patient to step into a machine, get a diagnosis, undergo surgery or receive treatment and recover all in one place.

"For example, in war zones, we wouldn't need doctors or surgeons being out there," Stamper says. "We could have this machine that does everything to standard and doesn't get tired and doesn't make mistakes. To fund that idea, I need to start saving now."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Check out:

The budget breakdown of a 26-year-old med student earning $28,000 in New York City

This 27-year-old former stock trader earns $650,000 a year in LA—and she's on her way to $1 million

This 26-year-old earns $78,000 per year as a full-time magician in New York City

Sign up now: Get smarter about your money and career with our weekly newsletter