Former President Donald Trump took aim at President Joe Biden over inflation during a call-in appearance on CNBC's "Squawk Box" on Monday.

"People are going through hell," due to rising prices, Trump said, with energy and food costs "through the roof."

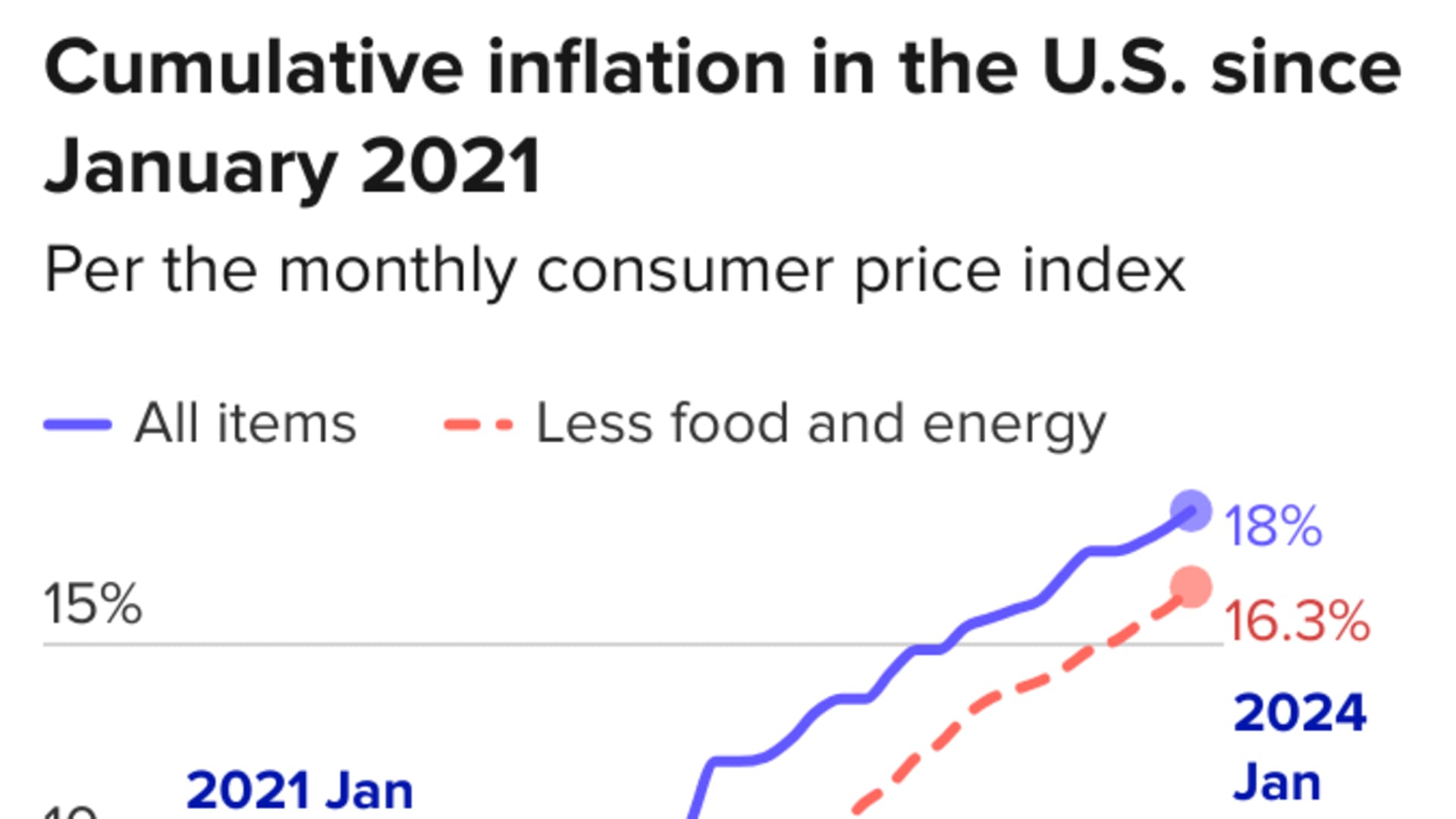

Trump then made the false claim that cumulative inflation was up as much as "over 50%" in the past few years.

Economic data shows Trump is overstating the rise in inflation. While inflation has hit Americans hard in the past few years, cumulative inflation is up 18% since 2021, when Biden took office.

The inflation rate is based on consumer price index data which measures the cost of everyday items that Americans tend to buy.

Here's a look at what cumulative inflation is, why it matters and how it compares with wage growth.

Money Report

Cumulative inflation is up 18% since 2021

The most common benchmark for inflation is the year-over-year rate, which is currently 3.1%, as measured by the CPI index. Year-over-year inflation has decreased steadily from its peak of 9.1% in June 2022 — the highest rate since November 1981.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

The year-over-year rate is still above the Federal Reserve's target of 2%, though, and has been hovering between 3% and 4% since June 2023. This is one reason why Federal Reserve chair Jerome Powell recently said that progress against inflation is "not assured."

However, the year-over-year inflation rate can hide the true impact of rising inflation over the years. Cumulative inflation, on the other hand, measures the total increase in the price of goods and services over a specific period of time.

If you look at cumulative inflation since January 2021, when Biden took office, the rate of CPI price growth is 18%. That comes out to a yearly average of 6% — again, well above the Fed's target of 2%.

That said, despite the surge in prices over the past few years, there are signs that the worst of inflation is over.

For one, wage growth has outpaced inflation since May 2023. Assuming the trend continues, the total gap between household buying power and inflation will close in late 2024, Bankrate reports. Based on those estimates, cumulative wage gains since January 2021 will be around 20%.

Recent data supports this trend. The wage growth rate increased by 5% in January 2024, as measured by the Atlanta Fed's Wage Growth Tracker, a three-month moving average of nominal wage growth for individuals. Before the pandemic, the rate of wage growth was closer to 3.5%.

Wage gains might also help explain the recent 29% surge in consumer optimism since December, as measured by the University of Michigan Surveys of Consumers. While still 20 percentage points lower than it was in 2019, many economists attribute the increased optimism to more raises and slowing inflation.

Wage gains vary widely by industry, but those most affected so far have been middle-income and lower-income households, according to economists from the U.S. Department of the Treasury.

Want to make extra money outside of your day job? Sign up for CNBC's new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Register today and save 50% with discount code EARLYBIRD.

Plus, sign up for CNBC Make It's newsletter to get tips and tricks for success at work, with money and in life.