BY THE NUMBERS

U.S. stock futures were mostly lower Thursday, and the 10-year Treasury yield was higher, just over 1.6% ahead of a burst of morning economic data. The market saw modest gains Wednesday, supported by stocks tied to the economic reopening. (CNBC)

The S&P 500 ended less than 1% from its May 7 record close. With two trading days left in May, the Nasdaq was up nearly 2% for the week but down 1.6% for the month. The Dow Jones Industrial Average and S&P 500 were up for the week and the month. (CNBC)

* For CNBC Pro subscribers: RBC upgrades Ford on its new electric vehicle strategy, sees shares rallying 22%

The government is set to issue three key economic reports at 8:30 a.m. ET, one hour before the opening bell on Wall Street: Initial weekly jobless claims, the second estimate of first-quarter gross domestic product, and April durable goods orders (CNBC)

This week's meme stock rally was set to take pause Thursday. Shares of GameStop and AMC Entertainment, both popular with Reddit traders, were under pressure in the premarket. However, GameStop surged nearly 16% on Wednesday and almost 44% in the past month. AMC soared 19% on Wednesday and 70% over the past month. (CNBC)

* Cramer says investors who are short GameStop and AMC are out of their minds (CNBC)

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

IN THE NEWS TODAY

Major bank CEOs are set to face a second round of grilling by lawmakers as they testify before the House Financial Services Committee today. There were fireworks at the Senate Banking Committee's hearing Wednesday when Sen. Elizabeth Warren went after JPMorgan Chase's Jamie Dimon concerning overdraft fees during Covid. (Reuters)

President Joe Biden has ordered a closer intelligence review of what he said were two equally plausible scenarios of the origins of the coronavirus. Biden revealed that earlier this year, he asked the intelligence community to assess "whether it emerged from human contact with an infected animal, or from a laboratory accident." (CNBC)

* Immunity to the coronavirus may persist for years, scientists find (NY Times)

* FDA gives emergency use approval for Vir-GSK Covid antibody drug (Reuters)

Money Report

The leaders of trade talks between the U.S. and China held their first call Thursday under President Joe Biden's administration, China's Ministry of Commerce said. The ministry said both sides agreed to further communication and characterized the call as one bearing an attitude of "mutual respect." (CNBC)

* GOP senators oppose Biden intelligence nominee who did legal work for Huawei (CNBC)

An employee who gunned down nine people at a California rail yard, and then killed himself as law enforcement rushed in had talked about killing people at work more than a decade ago, according to 57-year-old Samuel Cassidy's ex-wife. (NBC News & AP)

* 'Enough': Biden urges Congress to pass gun control bills (USA Today)

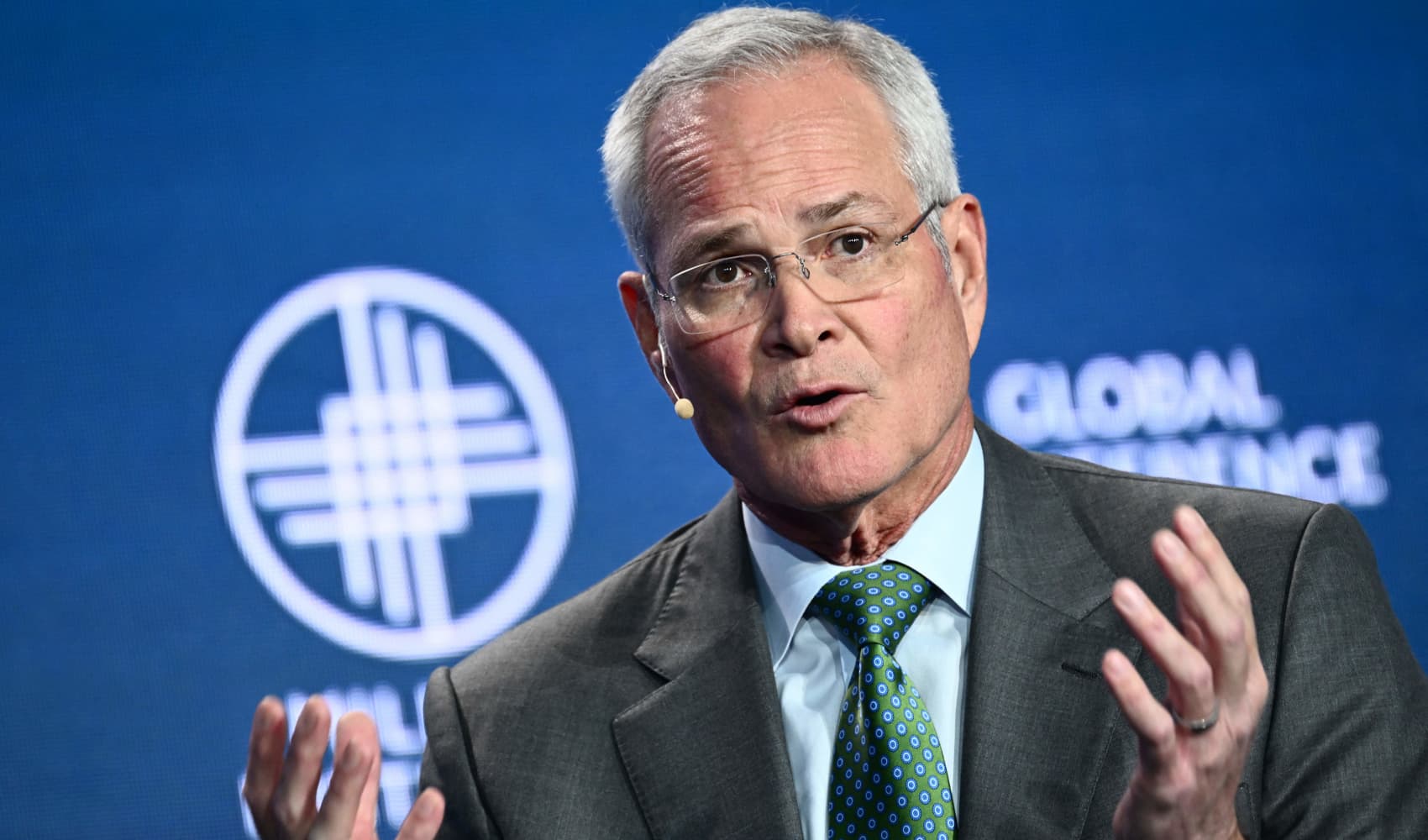

Engine No. 1 won at least two board seats at Exxon's (XOM) annual shareholder meeting on Wednesday. The activist fund, which has a 0.02% stake in Exxon, has been targeting the company since December over the oil giant's need to shift away from fossil fuel dependency. The vote over a third candidate proposed by Engine No. 1 was still too close to call. (CNBC)

* Dutch court rules oil giant Shell must cut carbon emissions by 45% by 2030 (CNBC)

* Big Oil defeats represent a watershed moment in the climate battle (CNBC)

Snowflake (SNOW) said in its earnings release on Wednesday that it no longer has a corporate headquarters, as its workforce is "globally distributed." The company designated Bozeman, Montana, as its principal executive office because it's required by the SEC to have one. (CNBC)

Walmart (WMT) and Gap (GPS) will launch a new brand, Gap Home, with bedding, bath and decor. The initial collection will debut on Walmart's website June 24 and eventually be available in the discounter's stores. With the multiyear deal, Walmart aims to drive more online sales and Gap wants to strengthen its brand among shoppers. (CNBC)

Acorns said Thursday it will merge with with Pioneer Merger Corp. (PACX), a publicly traded special purpose acquisition company. The SPAC deal values Acorns at roughly $2.2 billion, more than double its last private valuation. When the transaction is finalized, Acorns will trade on the Nasdaq. (CNBC)

* Discloser: Comcast's venture arm and NBCUniversal are investors in Acorns. Comcast (CMCSA) also owns CNBC.

STOCKS TO WATCH

Best Buy (BBY) shares jumped 3.8% in the premarket after the electronics retailer reported quarterly earnings of $2.23 per share, which beat the consensus estimate of $1.39 a share. Revenue and comparable-store sales also exceeded Wall Street forecasts and Best Buy raised its full-year comparable sales forecast.

Dollar General (DG) reported quarterly profit of $2.82 per share, beating the consensus estimate of $2.19 a share. Revenue exceeded estimates and comparable-store sales dropped less than expected. Dollar General also raised its full-year forecast. However, shares fell 1.5% in premarket trading.

Dollar Tree (DLTR) shares fell 2.7% in the premarket after it issued a lower-than-expected earnings outlook for the full year. Dollar Tree beat estimates on the top and bottom lines for its latest quarter, and comparable-store sales rose more than expected.

Williams-Sonoma (WSM) earned $2.93 per share for its latest quarter, beating the consensus estimate of $1.83 a share. The housewares retailer's revenue came in above forecasts, and it also gave an upbeat outlook as shoppers continue to invest in their homes. The stock rose 3.3% in premarket trading.

American Eagle (AEO) beat estimates by 2 cents a share, with quarterly profit of 48 cents per share. Revenue was slightly above projections. The apparel retailer benefited from increased spending by customers who received stimulus checks. Shares were up in the premarket.

Medtronic (MDT) beat estimates by 8 cents a share, with quarterly earnings of $1.50 per share. Revenue beat estimates as well, as medical procedures rebounded amid a receding pandemic. Medtronic also raised its dividend by 9%. However, the stock fell nearly 1% in premarket trading.

Nvidia (NVDA) reported quarterly profit of $3.66 per share, compared to a consensus estimate of $3.28 a share. Revenue exceeded forecasts, with the chip maker also issuing an upbeat revenue outlook. Nvidia said it could not determine how much of its revenue increase was generated by sales to crypto miners. The stock was up modestly in Thursday's premarket.

Workday (WDAY) beat estimates by 14 cents a share, with quarterly earnings of 87 cents per share. The maker of human resources software's revenue also top estimates. Despite the beat and an upbeat outlook, Workday shares fell 1.1% in the premarket.

WATERCOOLER

The long-awaited, much-hyped reunion between the six original cast members of "Friends" hit HBO Max on Thursday. "Friends: The Reunion" gathered all six actors on the set of the hit 1994-2004 sitcom chatting and reliving emotional moments. (USA Today)