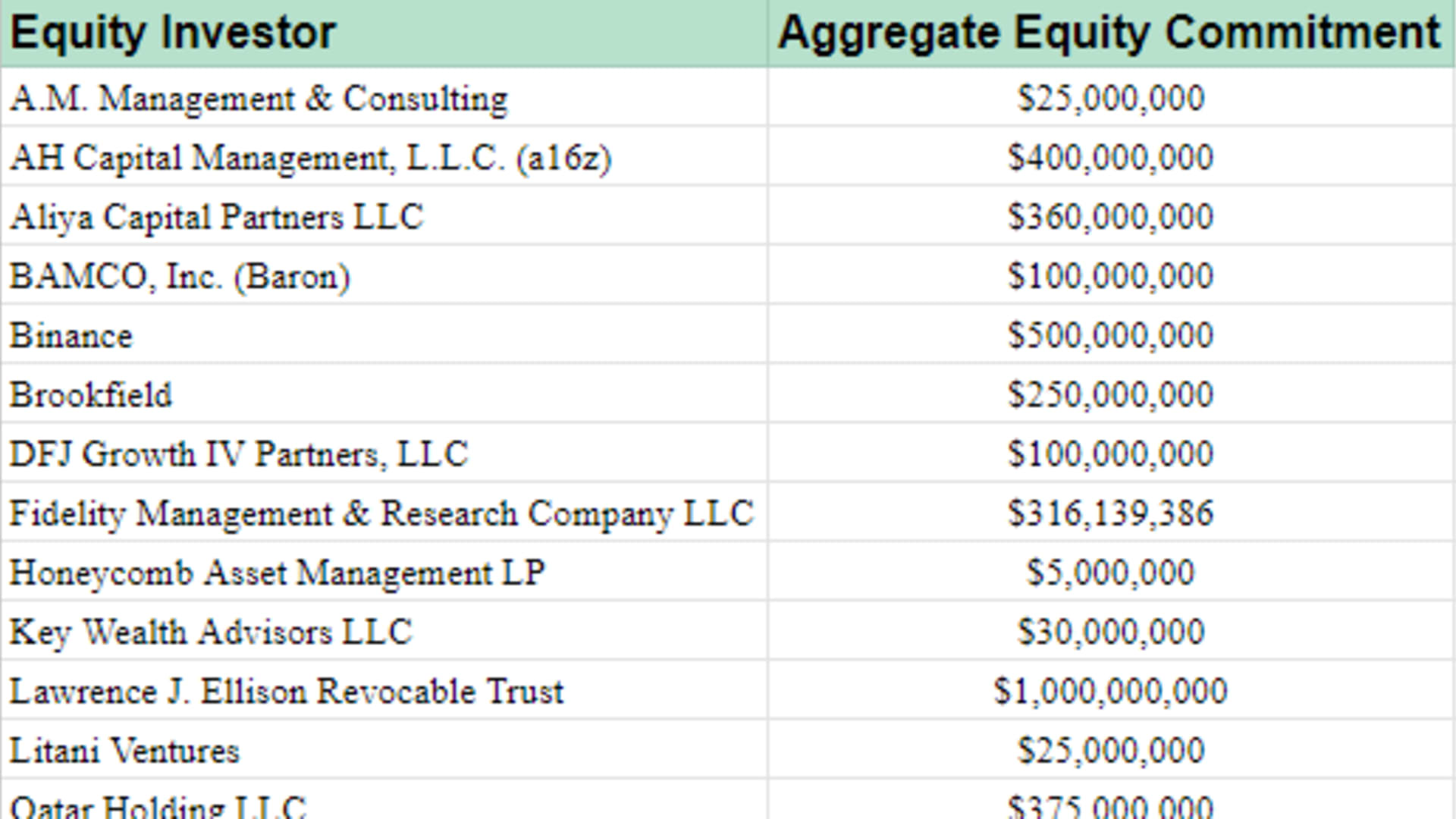

- The SEC filing, published Thursday, shows that Ellison is contributing $1 billion, while Sequoia is contributing $800 million.

- Binance, which has no doubt benefited from Musk's love of crypto, has committed $500 million.

- Other investment firms backing Musk's bid include Qatar Holding, which is contributing $375 million, and Fidelity, which has pledged $316 million.

A new filing shows that Oracle co-founder Larry Ellison, venture capital firm Sequoia and crypto exchange platform Binance are among a cohort of investors that plan to support Elon Musk's $44 billion Twitter takeover.

The SEC filing, published Thursday, shows that Musk has secured $7.14 billion in total.

Multibillionaire Ellison is contributing $1 billion, making him the biggest new backer, while Sequoia is contributing $800 million. Binance, which has no doubt benefited from Musk's love of crypto, has committed $500 million.

Other investment firms backing Musk's bid include Qatar Holding, which is contributing $375 million, and Fidelity, which has pledged $316 million.

The new commitments will help Musk to cut the margin loan he has taken from $12.5 billion to $6.25 billion.

Money Report

Saudi Prince Alwaleed Bin Talal Abdulaziz Alsaud, who is already an investor in Twitter and initially rejected Musk's deal, has pledged to buy 34,948,975 shares, worth around $1.7 billion.

The prince said April 14 that Musk's bid for Twitter, which works out at $54.20 per share, comes close to the "intrinsic value" of the company given its "growth prospects."

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

He added, "Being one of the largest & long-term shareholders of Twitter, @Kingdom_KHC & I reject this offer."

Twitter's stock is currently trading at around $50.

Here's a look at the equity commitments: