This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

Steve Adcock wakes up at 6 a.m. every day. He starts his morning with a workout in his home gym before settling down at his desk to check emails and browse social media. By 10, when most of America's other 39-year-olds have logged on for work, he's getting ready to take his dog for a walk around his desert property in Pearce, Arizona. It's a tried and true routine for Adcock, who has been retired for the past five years.

Adcock didn't always have such a relaxed life though. He spent 14 years working in information technology, a career that "pays well, but tends to drain the life out of you," he tells CNBC Make It. After more than a decade of work, he realized it was time for a switch.

"In my early 30s, I came to the realization that I just could not spend the rest of my life sitting in front of a computer, working 10 to 12 hours a day, writing computer code or fixing problems," he says. "I just couldn't do that."

He approached his wife Courtney, now 36, with the idea to retire early. Though she was less sure about retiring than Steve, thanks in part to her fondness for her job as an engineer, she eventually came around to it. The couple formed a plan to cut their spending and save 70% of their combined income so they could quit their jobs and travel the country, living only off of the growth of their investment accounts.

Steve and Courtney retired in 2016 and 2017, respectively, with a combined net worth of $870,000. Despite not adding a penny to their investments in the ensuing half-decade, they are now worth about $1.2 million and don't plan to head back to the office any time soon.

How the Adcocks retired in their 30s

In 2014, when Steve and Courtney decided to join the FIRE (financial independence, retire early) movement, their net worth was roughly $650,000, including the estimated equity in their home, which they planned to sell. They determined that they needed a total of $800,000 to $900,000 in order to retire in their 30s. They were bringing in around $230,000 combined each year.

Thanks to their high salaries, Steve and Courtney were able to max out their 401(k) contributions in the years leading up to their retirement. They also slashed their spending, eliminating monthly subscriptions and streamlining their grocery budget. "At one point we were saving 70% of our combined income," Courtney says. They funneled all of the extra savings into a Roth IRA, brokerage account and savings account.

Get a weekly recap of the latest San Francisco Bay Area housing news. Sign up for NBC Bay Area’s Housing Deconstructed newsletter.

Money Report

The couple also moved out of their 1,600-square-foot home in Tucson, complete with a swimming pool, and into a 2005 Airstream that they purchased for $42,000 in cash.

By August of 2015 their net worth was up to $775,000, and they eventually hit their goal in late 2016, a little less than three years since Steve decided he wanted to retire.

Courtney has always been more of a saver, Steve says, and even though retiring early was his idea, he had the harder time reigning in his spending habits. Perhaps the most drastic change they made was limiting their restaurant budget to $50 per month, a difficult task for Steve, a restaurant aficionado who says he once made a point to visit an eatery a day for a full year.

"Before we got married, I spent a lot of money. I had a supercharged Corvette convertible. I had a brand new Cadillac CTS. I had a Yamaha sportbike. I had all the toys," he says, noting that they have all since been sold. Now, the couple shares one pickup truck, which they use to pull their Airstream when they travel around the country.

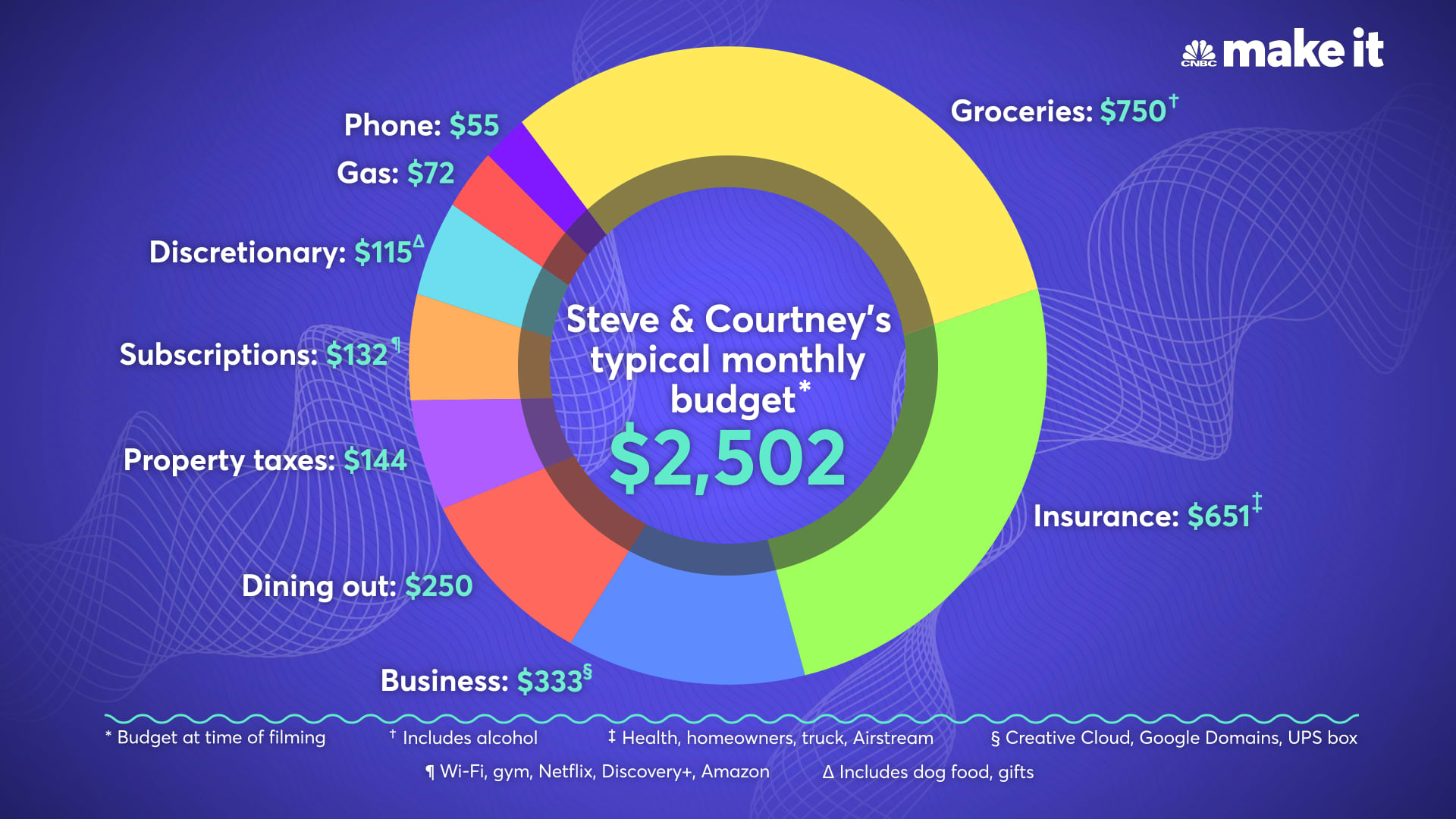

How they budget their money

Here's a look at how the Adcocks spend their money as of April 2021.

- Groceries: $750 (Includes alcohol)

- Insurance: $651 (Health share plan, homeowners, truck and Airstream insurance)

- Business: $333 (Includes Adobe Creative Cloud, Google Domains, UPS box and more)

- Dining out: $250

- Property taxes: $144

- Subscriptions: $132 (PlanWiFi, Planet Fitness, Netflix, Discovery Plus, Amazon Prime, Kindle Unlimited)

- Discretionary: $115 (Includes dog food and gifts)

- Gas: $72

- Phone: $55

The couple have a combined checking account as well as a combined savings account, which helps keep their financial lives simple and straightforward, Steve says. They discuss every purchase they make and only spend money on things they agree on.

Because they don't have steady paychecks coming in from an employer, the Adcocks are careful with their budget. Their two main splurges are on nice spirits, so that they can make cocktails at their home bar, and visiting each of the restaurants in their small town once a month.

They've also found other ways to eliminate spending, including moving into a 800-square-foot house on a 6.7-acre parcel of land in the Arizona desert, which they purchased for $72,000 in late 2019. They added a high-end solar panel array in October 2019 for $28,000, which keeps the house off the power grid and eliminates monthly electricity bills. They also have a septic tank on-site and collect rainwater, which lets them avoid water and sewer bills.

They spend about $500 combined for a health share plan, which gives them the ability to see any doctor at any time and be treated as a cash-paying patient. For dental, they periodically venture an hour south across the border to Mexico, where a cleaning costs around $25.

Living off their savings

To figure out how much they can afford to spend each year, the Adcocks follow the "4% rule," which says that early retirees can in most cases safely withdraw 4% a year from their retirement savings portfolio. The number is half of the 8% long-term historical average return on balanced portfolios.

Under this rule, the amount they can spend may fluctuate year-to-year, but has gradually increased over time as their investments have grown.

"If we're having a good year and we're making money, we can be a little bit more flexible with our lifestyle," Courtney explains. "And then if we're in a down market, we will really cut back and get our [annual] budget more in the $30,000 to $40,000 range instead of up near $50,000."

The couple keeps the majority of their investments in targeted retirement funds, which Steve likes because because they are automatically diversified to reduce risk. He firmly believes that investing "doesn't have to be hard" and never tries to time the market or pick stocks.

The couple also aims to keep at least two years' worth of expenses in their high-yield savings account at all times, which amounts to somewhere between $60,000 and $80,000. Even though it's a large amount of money that could be working for them if it were tucked away in investments, Steve and Courtney enjoy the peace of mind that comes with knowing their needs will be taken care of should the markets run into trouble.

The strategy helped them weather the storm when the market crashed at the beginning of the Covid-19 pandemic. The Adcocks stuck to their savings and didn't sell any investments — even when their net worth was down almost $200,000 in March 2020 — and are now in a better position than when the pandemic started.

Life 'in the middle of nowhere'

Before Covid-19 forced them to hunker down at home in Arizona, the couple spent most of their time exploring the country in their Airstream.

But since they've been home, the Adcocks have invested in their property by adding a gym in their garage and building out a small home office. They are also hoping to install a well in the near future — a project that could cost close to $30,000.

But with five years of retirement under their belt, and a lifetime to go, the Adcocks are no longer phased by needing to spend their hard-earned money.

"The longer you are retired early, the more you control your life," Steve says. "Today we spend way more money compared to what we spent back in 2016 when we first retired early, because we have a really good feel of the things that make us happy and the things that we should be spending money on."

Life as an early retiree

Though Steve hasn't formally been a part of the workforce since 2016, that doesn't mean that he spends his days playing golf and watching Netflix. "Early retirement, to me, is the ability to control nearly 100% of your day without the need to work a full-time job to fund your lifestyle," he says.

Steve takes on work once in a while when he is presented with opportunities that he finds interesting or exciting. Over the past year, he has earned just shy of $15,000 from his e-books, YouTube channel and taking odd jobs in IT. He doesn't set a goal for how much work he wants to do each year, but keeps in touch with recruiters who reach out when they have something they think he might like.

"I like to earn an income doing things that I like," Steve says. "I don't do what I do because I need the income. I do what I do because I think it's cool. It's thrilling to do something you fundamentally enjoy and get paid for it."

Courtney says that the freedom granted by her early retirement has also allowed her to take on jobs that she may have passed on previously because the money wasn't good enough to support her lifestyle. She currently volunteers on the board of a local project that is trying to create a local water system for their area and runs a small YouTube channel that promotes creativity though activities like knitting and wire weaving. She donates 51% of the profits to charity.

"Now you can work for free," she says. "You can volunteer not only money, but time. You have a lot more options in terms of what you can do to help out and be of service to others than when you might have been working."

The Adcocks admit that their choices are different from many other people their age, but they have no desire to go back to their day jobs. Though Steve misses his frequent restaurant visits, he firmly believes that early retirement is worth the trade-off, while Courtney says that the penny pinching needed to get to this point was easy enough to embrace.

"If you think about it as sacrificing, as what you're giving up, you're going to have a very hard time not spending like your friends," Courtney says. "But if you think about it as what you're gaining, if you have that vision of the future, it really made it not feel like a sacrifice."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: Here’s how much money you’d have if you bought $1,000 worth of Netflix stock in 2011